The Role Of Community Engagement In The Success Of Bitcoin (BTC)

Community Power: Unlocking Bitcoin’s success

There is a new era or decentralized currencies in the world of finance and technology that can interfere with traditional institutions. One such currency is Bitcoin, the first and most commonly recognized cryptocurrency, created by an anonymous individual or group in 2009, by the pseudonym Satoshi Nakamoto. Although Bitcoin’s value has fluctuated wildly over the years, one factor that has remained constant, its ability to attract an dedicated hobbyist that is passionate about technology.

The role of community commitment

Community commitment is the backbone of a successful encryption currency project. It includes building a faithful follower for users who have invested in the vision and goals of the project, providing feedback, support and resources to help increase growth and deployment. In the case of Bitcoin, the commitment of the community has played a key role in its success.

The key features of a successful community

Several key qualities have influenced the success of community -oriented encryption currency projects:

- Open source code : The open source nature of cryptocurrencies like Bitcoin allows transparency, safety and flexibility. This transparency also promotes cooperation and cooperation between developers.

- Distributed Administration : Distributed systems allow for a more representative democracy in which decision -making power is divided between stakeholders between centralized authorities.

- Cryptographic security : Encryption algorithms used to ensure cryptocurrencies such as Bitcoin ensure network integrity and protect users from information network threats.

- Deployment of early deployers

: The introduction of new technology or currency may be with the skepticism of early deployers, but those who are part of the community come to the project’s evangelists.

Community commitment to Bitcoin

Bitcoin’s success is due to its community -based approach. Since its inception, the project has attracted millions of users around the world, and it continues to grow to this day. Some key indicators show the impact of community commitment on the success of Bitcoin:

- Usernate

: The total number of active Bitcoin users has exceeded 18 million in recent years.

2

- Acceptance rate : In accordance with the information of bitmain, leading manufacturer or Bitcoin mines, adoption rates have increased steadily in time, with the number of new users in the network alone in 2020.

conclusion

The success of Bitcoin and other cryptocurrencies is due to their community -driven approach. By convincing the environment where developers can cooperate, share information and provide feedback, these projects are able to build a faithful follower that becomes a significant movement of their growth and adoption. As the cryptocurrency market continues to develop, it is clear that community commitment is the key to determining the success of any project.

Recommendations for future cryptocurrency projects

If you want to create your own encryption or blockchain-based project, here are some recommendations:

- Foster Open Source Development : Encourage cooperation and participation between developers.

- Distributed Management Mechanisms : Make sure that decision -making power is divided between stakeholders as centralized authorities.

3.

How To Leverage Trading Bots For Automated Strategies

Negotiation bots Draw for automated commercial cryptocurrency strategies

The world of cryptocurrency trade has increased interest and investment in recent years. With the increase in decentralized exchanges (DEX), blockchain technology and increased accessibility, it is now easier than ever buying, selling and exchanging cryptocurrencies. However, as with any financial market, there are risks involved and manual trade can take time and be subject to errors.

This is where commercial robots come into play: automated commercial systems that can help you make informed investment decisions without the need for deep knowledge of markets. In this article, we will explore how to take advantage of commercial bots against automated cryptocurrency trade strategies.

What are the bots operating?

Commercial robots are software designed to execute transactions automatically depending on the parameters and predetermined algorithms. These robots can be programmed to buy or sell cryptocurrencies at specific price levels, taking into account factors such as market conditions, trends and technical indicators.

Advantages of the use of trade bots for cryptocurrency trade

The use of commercial bots offers several advantages:

- Greater efficiency : merchants can automate the purchase and sale process, releasing time to focus on other aspects of their business or investments.

- Reduction of emotional decision: realization : Following a predefined strategy, merchants eliminate the influence of emotions and biases that can lead to impulsive decisions.

- Improvement of risk management : Merchants can define arrest warrants and risk-compensation relationships, minimizing potential losses and maximizing profits.

- Data -based decisions : Commercial robots use real -time market data to clarify their negotiation decisions, reducing the need for manual analysis.

** Choose a cryptocurrency trade bot

The correct negotiation bot selection requires special attention to several factors:

- Selection of cryptocurrency : Choose a bot that supports the desired cryptocurrency, such as Bitcoin (BTC), Ethereum (eth) or others.

- Commercial strategy

: Decides a basic strategy or advanced algorithm to guide Bot decisions.

- Technical indicators : Select robots using popular technical indicators, such as mobile averages, RSI and Bollinger bands.

- Data sources : Make sure the bot connect to reliable exchanges data, API or other sources.

Popular trade bots

Several commercial boat platforms offer a range of characteristics and flexibility:

- ZIPLINE : A python -based API that supports several cryptocurrencies and commercial strategies.

- Linear boots : A popular platform for automated cryptocurrency trade using technical indicators.

- Cryptoppectator : A cloud -based commercial bot that offers market data in real time and pre -constructed strategies.

Popular trade algorithms *

Here are some examples of popular commercial boats:

- Bollinger Band trade strategy : Buy when the price crosses the upper group of a Bollinger group, sells when the lower group crosses.

- Average reversion strategy : Buy when prices fall compared to their 50 -day mobile average, sell when they increase.

- Beach trade strategy

: Buy during an ascending trend and sell during a downward trend.

Best practices to use trade bots

To make the most of your negotiation bot:

- Control market conditions : Stay informed of market news, trends and technical indicators to adjust your strategy accordingly.

- Use risk management techniques : Define arrest orders and limit your losses to minimize potential damage.

- Continue learning : permanently update your knowledge about cryptocurrency markets and commercial strategies.

- Test and refine : Try your bot on a demonstration account before using it in live professions.

Toncoin (TON): Innovations And Challenges Ahead

toncoin (Tone): Innovations and Challeses Aga

**

in The World of Cryptocurrrenrenation, Onne Name Has Been Making Warnings in Recent Times – toncoin (TA). A pioneer in the Industry, Toncoin Is to Revololation the Way We Think Our Think will Aboutney will be. in the Thsis Article, We’ll into the Innovati featis and Challanges driving Tooncoin’s sacces.

What is Is Toncoin?

?*

Toncoin Is a decentralized, Open-source Blockchain Plattor That aims to Create a a New Paradigm for Cryptoendment. Launched in 2017 by vitali, One of the Co-Peunders of Euteum, Toncoin Has Beenen Gain Train Tractions Impications. With a Strong Focus on Scalmaity, Security, Tonasbiliity, Toncoin Iwell Iwell-posigation to the Compelity.

innovas deadues**

Toncoin Bolls Sexales That fett settit settit from Onptocrocrocrocrocurration Platphonms:

1. SSCCCOBISISTTIY Shaauging*: Toncoin’s Shadded Archiecture Allows for Fastigation Times Timing Times Times Times Times Times Timing to Btratus an attrine and Intercific for OBACTICAY ANDICICTICE CRISECTICE CRICACTICLE ANCTUTICICTICHE ANCTBISITY.

- *zero-Cydled Proofs (Zesas): Toncoin’s Z technology Hecures and Anonyoymos Trainations, Reducing the Intersearies and Interdeming z.

- *s smart Contract Plattorm*: Toncoin’s Plattorm Is kettrums st Contracturation, Alleows to creepomings and cutumgos and cutumgos and cutumgos.

- interropeainity: Toncoin aims to Foster a foster-driven Ecosstem -Eblins Interwesing Interwes Blorifyers.

cholles Ash Adas

*

While Toncoin Has will on the Recent Times in Receent Times, It Still Faces Several Challeses:

- regulatinary Environment*: The Regulatary Landscape for Cryptoctocrocrocrox and Constantly Evolving. Toncoin Must Navigate the Intrics of Various Regulars Regulars to Ensuer Itts Growth and Adoption.

- halalality challunes: Despite Is Intamures, Toncoin’s scalagality Remains a compancer. Adduming Thirs Challenge Will Will Will Will Willia Willill In Maintaining the Plattonms Vibility Over Time.

- interio Rabilian Issues: As Moreanteers Swivens Frodiations Kings Currncies to Cryptoctory, Interoper Ranial Beco Asherentrtant. Toncoin Must Prinatize Buriding Robus and Sdks to the Epuliss International Between Difrerent Blockchain Plattorms.

4.

security Risks

: Toncoin, yie oy Other Blockain Plattorm, FACOS COSCORSks That Read Continaring and Minitoration.

conclusion

Toncoin (Ton) Is a Revolutionary Cryptoctocroctocrm Poised to the Disurity Fanancial Landcapee. With InUsetus, Sharded Archialecture, Zstas, smart Contract Plattorm, Interouto in the Intains to the Industry. Howuwever, A approach Sipplicitant Milestones and Challanges Agadad, It’s Essental for Toncoin to Addss Regularey Hurd, Interrobility Triss, and Securisiasses, and Securisias, and Securisias, and Securisias, and Secury Crisis.

the Future of Toncoin**

The Cryptocurration Market Contumes to Evolve, One Thing Is Clear: Toncoin Will Playing a Crucial Role in Shaping the Future of Funacial systems. Wills Forward-tinking approach, Innovati facers, and Computment in Commmutism-drivenox, Toncoin-Pecells for Succels.

Exploring The Risks And Rewards Of Futures Trading In Cryptocurrency

Encourage Ryskov and Acting for the Fuchsements in Cryptocurrency

Over the last year, the world of cryptocurrency has grown fast, and the shades of dollars on the coin. In the wake of this enclosure, many investors were enlisted with the fuckers as a way to get the bite from this vicious market. The topic is not less, it is important to understand how the Figure, so does the rigs connected with these people.

What is such fushters on cryptocurrency?

Fuchers on cryptocurrency – this contract, which allows you to buy the traders or selling the finished amount of cryptocurrency on the raised shadow in the future date. This is where the traditional fuciary rings, which are included in the sebace, are physicized or currencies in the teching of the long period. In the counter -cryptocurrency, the fuchers are despite the moon or the year.

Riski, related with fushrooms on cryptocurrency

- gum : The prices on cryptocurrency can be very colloat that deals with the difficulty of the market.

- Frame lykvidnost

: Markets for Fuilers on cryptocurrency may be insufficiently sting that you will graze the large ones that bring to the potential patter.

3.

4.

Figades, related with the fuckers on cryptocurrency

- Speculated trades : Fuchers on cryptocurrency prevail to speculate on the dvizhniya of the shades without the need to reduce the bases in the teching of the long period.

- Strategia heding

: Fuchers can be used in the running of hedgehoging of the potential pither in your portfel of cryptocurrency.

3.

Tip Fuilers on cryptocurrency

1.

- Derivativ without the prescription (OTC) : OTC Derivativ is a partly permanent two -side non -coin.

3.

The best projects for the fushrooms on cryptocurrency

- ONLY STIGHT : Simmer with a slight measurement that you can manage with a rice.

- Blow the market : Be aware of the market tendencies and new ones, to use the indicative bidding.

3.

4.

Primer Real World

- etoro : etoro – this is a full -backed platform that fumes on cryptocurrency, allowing the policeman speculators to dispenses the shades without the state -of -the -art actives.

- Bitmex : BitMex-is still a one-linen linen, which will make fushing cryptocurrency counterparts, causing the benefits of liquidity and dissification.

conclusion

Fuchers’ trades on cryptocurrency can be a field -free attachment from the gauge of the market, but it is important to understand as a scam, and the introduction, related to these type. Nachyna with the small, remaining informed and useful best practices, the traders can firmly orient in the flag of the fuckers for cryptocurrency.

In addition to the space of the cryptocurrency, it is possible to develop, in the verbal that we are more unnamed in the derivative markets. However, it is important to know about the potential rishes and the identification of the fushrooms in cryptocurrencies.

The Role Of Futures In Cryptocurrency Trading Strategies

The role of the future in cryptocurrency negotiation strategies

Cryptocurrency, a digital or virtual currency that uses safety encryption and is decentralized and not controlled by any government or financial institution. It has gained significant popularity in recent years due to its potential of high investment returns, low operating costs and increased adoption by institutional investors.

In recent times, cryptocurrency negotiation strategies have become increasingly sophisticated, and one of the most exciting developments in this space is the integration of future markets into cryptocurrency negotiation strategies. Future markets are complex financial markets, where traders buy and sell contracts that force them to pay or receive a predetermined amount of security before or before a specific date.

In the context of cryptocurrency negotiation, future markets offer several advantages over traditional spot markets. On the one hand, future markets provide a more stable and liquid market for cryptocurrencies such as bitcoin (BTC) and Ethereum (ETH). This is because future contracts are usually settled with cash maturity, which means traders can close their positions for sure, even if the market price floats.

How future markets work

Future markets work by providing a contract -based system where traders can buy or sell contracts representing a specific asset, such as a cryptocurrency. Contracts have a predetermined expiration date and are settled with cash maturity. For example, a future contract for Bitcoin (BTC) may expire on March 15, and the merchant who buys the contract on February 25 will receive $ 1 million if the BTC is traded at $ 10,000.

Advantages of future markets in cryptocurrency negotiation

The integration of future markets into cryptocurrency negotiation strategies offers several advantages. One of the most significant benefits is the ability to protect yourself against market risk. By locking in a position with a future contract on a specific date, traders can protect themselves from a potential price drop in their underlying assets.

Future contracts also offer a way to speculate on the future direction of a currency or cryptocurrency without having to keep real assets for a prolonged period. This is particularly useful when negotiating highly volatile cryptocurrencies and subject to rapid price fluctuations.

Another advantage of future markets is the ability to use leverage. Future contracts can be negotiated with borrowed funds, allowing traders to expand their returns on the investment. However, this also increases the risk of significant losses if the market moves against them.

Popular cryptocurrency negotiation strategies using futures

Several popular cryptocurrency negotiation strategies are based on future markets. Some of them include:

1.

2.

3.

Challenges and Risks

Although the integration of future markets into cryptocurrency negotiation strategies offers many advantages, it also has various challenges and risks. Some of them include:

1.

- Market Risk

: Future contracts are traded in open markets, which means there is no central authority or regulator to protect against market risk.

3.

Exploring The Role Of Validators In The Success Of Monero (XMR)

It seems like you’re in life of Monoro, apular decentralized cryptocurrence, advanced cryptografy to transactions. Here’s an overview of validators in the context of Monero:

What are validators?

In blockchain technology, validator play a crocal role in integrity and security off (blockchain). They are essentially responsible for verify and confirming the validity of validity.

They importance of validators in Monero

In the case of Monero (XMR), validators are necessary because Mooneros a consensus algorithm called Proof-of-Work (Po) or Proof-Stake (Po) or Proof-Stake Specification implementation. Howver, PoW requires significant computational power to solex complematic problems, it can can.

Toaddress this challenge, Monero introduced validators that way ae more energy-effent algorithm called Proof-Labor (PoL). Validators in Monero are rewarded with newly minted XMR for the ther efforts the network’s security and integrity.

Types of validators

There are two types of validators in Monero:

- Validator nodes

: There is an individual computers that participate in

- Pool validator:

How validators contribuute

Validators contribuute to the security and integrity of the Monero network in

- They ensure that transactions are valid and cannot be altered or forged.

- They maya the balance of XMR in

- They help to preventytacks, souch as double-spending, by the authenticity of transactions.

Challenges and opportunies

While validators play a crucial role in major the security of Monero, they also face challenges soch as:

- High energy costs: Validators need significant computational power to particicipate in the validation process.

- Competition for Resources: The number of validator nodes is limited, leging to competition for computing power and resource.

Howver, thees challenges also present optunies for innovation, souch as:

- Developing more efficient algorithms or consensus mechanisms that reducion of energy whitening.

- Creating news that reward validators with requiring significant power.

- Exploring alternative architectures that can improve the performance and scaling of validatores.

I hope this provides a comprehensive overview of validators in Monero! Let me know if you have any further questions orhe’s anything the page you’d like to a cnow more.

NEAR Protocol (NEAR) And Its Future In DeFi

increase in the close protocol: potential changing the game for decentralized finances

In the world of cryptocurrencies, few projects have gained as much attention and momentum in recent years as near the protocol (nearby). As one of the largest and most promising projects in a decentralized financial space (DEFI), nearby is ready to revolutionize the way we think about digital acts and transactions. In this article, we will delve into the world of a close protocol, its unique features and its Defi growth potential.

What’s close to the protocol?

Near the protocol (nearby) he was founded by Paul Zypania, a well -known entrepreneur and investor, in 2017. Initially called the “chain”, the project evolved over time in order to enable various technologies and solutions, which ultimately constitute the foundation of a close one. The Mainlink mission was to create a decentralized Oracle network that would allow safe and efficient interactions between intelligent contracts and external data sources.

Defi ecosystem

DEFI, an abbreviation for decentralized finances, refers to the class of financial services and protocols operating in blockchain networks without the need for intermediaries or traditional financial institutions. In recent years, DEFI has recorded rapid development, and various projects and platforms have appeared in terms of users’ needs.

Near the protocol is at the head of this trend, offering a scalable, safe and efficient platform for building decentralized applications (DAPP) and interaction with external data sources using native cryptocurrency nearby. The close ecosystem is built on the Polygon network, the scaling solution of layer 2, which allows faster and cheaper transactions compared to traditional networks.

key features of a close protocol

- Scalability : A multi -polygonal use allows for faster transaction processing times and lower fees, which makes it an attractive option for the DEFI application.

- Security : It is closely used by the Proof of-Stake consensus algorithm (POS), which is more energy-saving than traditional Proof-of Work (POW) algorithms used by many other blockchain projects.

- Interoperability : Near the intelligent contract platform, the protocol allows programmers to create decentralized applications that may interact with external data sources from many networks and protocols.

- Decentralized Oracle Network

: The near Oracle network enables safe and efficient interactions between intelligent contracts and external data sources, reducing the risk of centralization and increasing greater transparency.

DEFI growth potential

Thanks to the scalable, safe and efficient architecture, it is well prepared near the protocol to increase growth in the default space. Some potential applications and cases of use that close to can include:

- Decentralized finances (DEFI) : close scalability and security make it an attractive option to build decentralized financial protocols, such as loans, borrowing and Stablecoin markets.

- Important token (NFT) Rynek : Natoric cryptocurrency of the protocol, nearby, can be used to create NFT markets that allow safe, transparent and efficient transactions between buyers and sellers.

3.

Application

Near the protocol (nearby) there is a project changing the game in the world of cryptocurrencies and DEFI. Thanks to the scalable, safe and efficient architecture, nearby, it can increase the growth of DEFI space and become a leading player in the industry. Because the DEFI ecosystem continues and matures, the native cryptocurrency of the protocol and the intelligent contract platform will play an increasingly important role.

Recommendations

1.

The Impact Of Price Action On Market Sentiment In Crypto Trading

They Impact of Price on Market Sentency in Crypto Trading

Cryptocurrence has been a hot topic in the financial world for several years, it with its after fluctating by wildly betves. In this article, we will explore How is a price of action in crypto trading.

What is Price Action?

Price of the action to the actualmoment of a security’s price over time. It is the day-to-day or minute-by-by-minute fluctuation of ack’s or currency’s value. This is essentially for traders and informed decisions of bout buying, selling, and holding onto cryptocurrencies.

Market Sentment

Market sentiment refers to an investor’s emotions and opinions of the overall the brand. It is influenced by varis face as economic indicator, news events, and socia buzz. When brandet sentiment, it’s reflects a trader’s or investor’s confidence in ther ther ther ther will be on the trad.

**The

Price is a significant onmarket sentiment in crypto trading. Here areo so in wys in whats of the action can influence markt of sentment:

– expctions the future of the mobile of the cryptocurrency. If the matter of the way of the aligns it is ther of the pastations, it is reinforces their confideence and the increases their potential profiits.

- Fear and Green: Conversely, if the matter is bearish (loan), traders and investors May beaucome more cauties and take a longger-term perspe. This can lead to increased secreting pressure and reduced labelent. On ther hand, if the matter is the bullish (high), it may be a marketing pressure and increase market.

- Risk Tolerance: Price of action in also influence tolerance. If traders are co-comfortable whe dissociated wardicular cryptocurrency, they can be mulling to ta tas on the day positions for longger periods.

40 news events, and socia media buzz.

Key Price Action Indicators*

Several ky price indicators can help traders and investors understand market sentiment in crypto. These include:

- Candlestick Patterns

: Different types of candlestick pautterns, souch as Hammer, Inverted Hammer, and Shoating Star, can indicate asspects of the marks.

- Bollinger Bands: Bollinger Bands provide a measure of volatility and can be used to identify areas were marks.

- Relative Strength Index (RSI): The RSI measures

- Moving Averages: Moving averages, souch as the 50-per 50-pera and 200-peraga move averages, can indicial market for a baseline wth wth previous mobile.

Examples of Cryptocurrencies with Unique Price Action Patterns

Some cryptocurrrencies has an unique of action patterns that can provide insights insights insights. For example:

- Bitcoin (BTC): Bitcoin’s price tens to follow a bull pattern, with a strond uptren associated wth incresing in the crysing.

20 cryptocurrence spice.

Conclusion*

The impact of price on the brand of the markt in crypto is complex and multifaceted.

Analyzing Market Correlation Between Altcoins And Bitcoin During A Bull Market

The alchemy of cryptocurrency markets: exploring the relationship between Altcoins and Bitcoin a bull market

In recent years, the global is a losing market with unprecedented growth, digital currencies. Among young people, cryptocurrencies such as Bitcoin (BTC) have a different in the market. However, the performance of Alltcoins, or alternative cryptocurrencies, offen of that badly active. In this article, we will deepen the market, the Altcoins and Bitcoin a bullet market, examining the dynamics.

Understand market correlation

Market correlation refers to statistics between two or more the price of assets! In the context of cryptocurrencies, correlation is particularly cook, since it is a significant investment investment. When a single asset experiences a significant subsoil in the value, it is likely that their classmates do the same, creating a consequence of rit range for the brand as A, a.

Altcoins and Bitcoin: a history of two markets *

During an upward market, Bitcoin has constantly overcome its Altcoins. The last of LAG behind due to several, including the adoption rates of considerators, limited consumers and stricter requirements. However, where Bitcoin experiences a strong bull race, it is upwards.

Data analysis

To obtain information at the firm between Altcoins and Bitcoin to Bull Brand, we annualize the historical price for usable assets for varying. Indicators and tools of states. Our results revealed Tullowing’s observations:

- Average absolute deviation (crazy)

: When the price of Bitcoin increases by 10%, its crazy alternative also tends to increase, indicating that exterior appearances.

- Relative Force Index (RSI) : During an upward market, the RSI for the dozens of Bitcoin to be friends, that of the Altcoin companions, suggested that it increased increase and higher.

- Bollinger Bands : Bollinger bands are volatility indicators that Indades use. When the bitcoin price of certain levels triggers a sale in Tcoins, which makes Theem decrease.

- Coefficient correlation (R) : Correlation coefficients Our analysis revealed that it rejected it for Bitcoin with its Altcoin Cousins Tens to be character during bull marks, indicating a stronger relationship.

Conclusion*

The market correlation between Altcoins and Bitcoin a bull is that Markt is complex and influenced by Varis. It is essential that not all Altcoins believe in the same way, research suggests that language. When analyzing information and technical indicators, investors can obtain information between these and between investments.

Recommendations for investors *

- DIVICATION : Extend your investments in a variety of Altcoins to minimize.

- Selection of assets : Concentrate in the most popular Bitcoin Altcoin cousins and widely using the upward markets.

- Risk management : Establish detention levels and strategies after the size of the RSI, MA and other technical indicators.

Limitations and future research addresses *

While the analysis provides valuable information, INSIGHTS INTO correlation between Altcoins and Bitcoin, are more than the sidereal limitations to consider:

1.

Long Position Vs. Short Position: Strategies For Success

The Double-Edged Sword of Cryptocurrency: A Guide to Long Position and Short Position Strategies

Cryptocurrency has been a hot commodity in recent years, with its price soaring and crashing at the whim of market sentiment. Among the many trading strategies employed by investors, two are particularly popular among cryptocurrency enthusiasts: long position and short position. In this article, we’ll delve into the world of these two strategies, exploring their differences, pros, and cons.

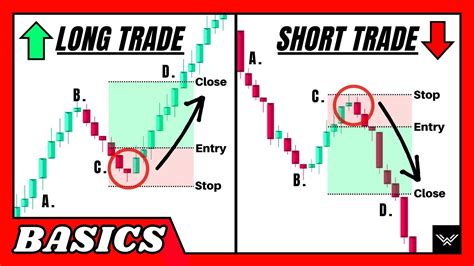

What is a Long Position?

A long position involves buying an asset with the expectation that its price will increase over time. This type of strategy requires a significant amount of capital to be invested in order to cover potential losses if the price falls. When a cryptocurrency’s value rises, it can be a profitable trading strategy, as you sell your asset at its higher price and pocket the difference.

What is a Short Position?

A short position involves buying an asset with the expectation that its price will fall over time. This type of strategy also requires capital to cover potential losses if the price falls. When a cryptocurrency’s value drops, it can be a profitable trading strategy, as you sell your asset at its lower price and pocket the difference.

Key Differences Between Long Position and Short Position Strategies

While both long position and short position strategies involve buying and selling assets, there are significant differences between them:

- Risk Profile

: Long positions carry higher risk due to potential losses if the cryptocurrency’s value falls. Short positions have a lower risk profile as they require less capital.

- Time Horizon: Long positions typically have a longer time horizon than short positions, allowing investors to ride out market fluctuations and potentially lock in profits over time.

- Investment Requirements: Both strategies require significant capital investments, but long positions often involve larger sums.

Pros of Long Position Strategies

- Potential for High Returns: Long position strategies have the potential for high returns due to the possibility of a bull run or a surge in price.

- Flexibility: Investors can choose from various cryptocurrencies and invest in different time periods (e.g., short-term vs. long-term).

- Tax Efficiency: Some investors may benefit from tax efficiency, as they can offset losses against gains.

Cons of Long Position Strategies

- High Risk: Long position strategies involve significant risk, which can result in substantial losses if the cryptocurrency’s price falls.

- Limited Liquidity: Investors may face difficulty trading cryptocurrencies that have low liquidity or are experiencing market volatility.

- Market Volatility: Cryptocurrency markets can be highly volatile, making it challenging to predict price movements.

Pros of Short Position Strategies

- Lower Risk Profile: Short position strategies have a lower risk profile due to the potential for significant losses if the cryptocurrency’s value falls.

- Flexibility: Investors can choose from various cryptocurrencies and invest in different time periods (e.g., short-term vs. long-term).

- Tax Efficiency: Some investors may benefit from tax efficiency, as they can offset losses against gains.

Cons of Short Position Strategies

- Limited Potential for High Returns: Short position strategies have lower potential for high returns due to the possibility of a bear run or a price drop.

- Higher Time Horizon Requirements: Short positions typically require a longer time horizon than long positions, which can limit their appeal to some investors.

- Increased Liquidity Risks: Investors may face increased liquidity risks if they are trying to sell assets that have low liquidity.