Scalping, Liquidity, Liquidation

“Breaking Code: Crypto -Scalping, liquidity and liquidation”

The world of cryptocurrency trading has evolved significantly over the last decade as decentralized exchange (DEX) and market manufacturing platforms rise. However, one aspect that is still a major concern for merchants is the liquidity that refers to the ability to buy or sell property quickly enough to utilize market opportunities.

Crypto Scalping: High frequency trading model

Krypto-scalping includes identification of potential trading opportunities in short time frames (usually 1-5 minutes) and the implementation of the shops is to benefit from small price changes. This strategy is based on the concept that prices usually return to their average over time, which constantly makes merchants’ profit.

Scalpers uses technical analytical tools such as diagrams, indicators and models to identify possible access and exit points. They also use a variety of market manufacturing strategies, including order book management and market information in order to stay up to date on market dynamics.

Liquidity: The Life Condition of Crypto Trading

Liikveitova refers to the property’s sales process when its price drops below a certain threshold, which utilizes lower prices for a possible loss. In the crypto trade, liquidity is crucial because it allows merchants to gain profits quickly and minimize losses as the market is transferred against them.

The high liquidity of the cryptocurrency market gives merchants the opportunity to get or leave the position more easily, reducing the time and effort needed for fast prices. This is particularly important in volatile markets where prices can vary rapidly, so it is challenging for merchants to maintain their financial statements.

Liquidist Strategies: The Last Way

In cases where the merchant does not have enough capital to exploit the possibility, it may be necessary to liquidate. Writers are companies that specialize in buying and selling funds at the level of need, such as in the library market or when prices have fallen due to market volatility.

Liquidation can occur for a number of reasons, including:

- The price instability : When a merchant believes that the price of the property is likely to fall, they can sell it at an unfavorable point and buy it later at a lower price.

- Lack of liquidity : It may be difficult for merchants to get or exit the position due to a small number of markets or due to the lack of buyers/sellers.

- Market Manipulation

: Liquidators can be repaired by artificially expanded prices, allowing them to take advantage of the situation.

When dealing with liquidation, merchants should approach it carefully and carefully consider the dimensioning of their status, stop loss and risk management strategies. It is imperative to understand that liquidation is the last resort and that it can lead to significant losses if they are poorly implemented.

conclusion

In summary, Krypto -scalping, liquidity and liquidation are critical components for successful cryptocurrency trade. By understanding these concepts and developing effective strategies, merchants can navigate in a complex market with confidence and increase their ability to produce profits. However, it is necessary to approach these aspects with caution and a clear understanding of the risks caused.

References:

- “Crypto Scalping 101”, written by coindesk

- “Cryptoslate Liquidity in the cryptocurrency market”

- “Bollinger Times strategies for encryption retailers”

Transaction fee, Market Signals, Price Volatility

Wild ride by trading crypto -valute: Understanding key concepts

Crypto currencies have existed since the early 2000s, but only in the mid-20110s they began to receive the main attention. The increase in digital currencies such as Bitcoin and Ethereum has led to an increase in the interests of investors, merchants and even everyday consumers. However, as with any form of investment or trade activity, there are several key concepts that you need to understand before you dive into the world of trading cryptocurrencies.

Transaction fees

One of the most significant aspects of cryptocurrency trading is the transactions fees. These fees differ depending on the specific crypto currency, but here’s the breakdown:

* Gas fees

: In most cryptocurrency networks, including Bitcoin and Ethereum, users pay gas fee to process transactions. This fee is usually measured in “gas” units, which are similar to dollars. The cost of gas can fluctuate depending on market conditions, with some cryptocurrency of the currency have lower gas fees than others.

* Transaction volume fees : If you are a frequent merchant or you want to perform multiple transactions at the same time, you will charge fees for the volume of the transaction. These fees are usually higher than gas fees and are calculated on the basis of the total value of all transactions.

market signals

Cryptocurrency markets can be very unstable, which makes the challenging prediction of prices. However, market signals such as:

* Growing trend : When the price of cryptocurrencies increases, it may indicate that the mood on the market is favored by the purchase.

* Sales pressure : In the opposite, when the price of cryptocurrencies decreases, it can signal sales pressure.

* Bullish and bearski indicators : Some crypto currencies have developed unique indicators such as “Fibonacci’s cut” or “Ichimok Cloud”, which can provide additional insights into market trends.

Price Volatility

The cryptocurrency markets are infamous in their instability of prices. This means that prices can vary quickly, sometimes in one day. Factors that contribute to this instability include:

* Bid and demand imbalance : When there is a significant increase or reduction of the number of coins that are mined or burned, it can lead to rapid prices changes.

* Market Sentiment

: As mentioned earlier, the market mood plays a key role in pricing determination. Fear and greed can increase prices up or down based on emotional reactions.

* Regulatory Development : changes in regulatory environments can affect the adoption and use of the Crypto currency.

Conclusion

Crypto currency trading carries inherent risks, including the market volatility, fees for transactions and liquidity issues. To succeed, it is crucial to be informed of the latest market signals, trends and conditions. By understanding these key concepts, traders can better move with the complexity of the cryptocurrency trading and make more informed decisions.

Ethereum: What are the obstacles to pegging the value of bitcoin to an established stable currency?

Calls of jumping bitcoin against established name

Ethereum, the second largest cryptocurrency on market capitalization, was presented as a potential alternative to the traditional entrusted name. One of the most important benefits of the Bitcoin armail compared to the established stable currency is that it can provide investors more predictable and more stable investment portfolio. However, it is not without any problems.

In recent years, many people have been afraid of investing in cryptocurrencies such as bitcoin because of their historically extreme volatility. Despite the market trend for fast price fluctuations, some investors still do not hesitate to participate. This phenomenon has led to an increase in interest in alternative currencies that can provide a more stable investment option.

However, the value of the bitcoin jumping against the specified currency makes several obstacles. One of the main challenges is the lack of standardization in the crypto market. In the absence of an organ management space, it may be difficult to determine clear guidelines and protocols to stabilize or jump cryptocurrency.

Another challenge is the technical difficulties associated with the achievement of stability. Although a stable currency has been determined, many technical considerations must still be taken into account, which must be taken into account, such as likvidence guaranteeing, maintaining the supply and demand and solving regulatory problems.

In addition, there are also concerns about the potential risks associated with the value of the jump bitcoin compared to the specified currency. For example, if the stability of the selected currency is not preserved, the cryptocurrency may undergo value loss, which can lead to significant financial losses for investors.

In addition, the value of bouncing bitcoin compared to a set stable currency may also limit cases of potential use and application cases. Some argue that this approach suppresses innovation and limits the capacity of the cryptom market to adapt to changing market conditions.

An example of Petro du Venezuela is the main illustration of the reason why the bitcoin value against the established currency is not a simple solution. In 2018, the Venezuelan government introduced its own Stablein, Petro, which was set for the US dollar at $ 1: 100,000, but despite the effort to stabilize the cryptocurrency, it failed due to insufficient institutional adoption and generalization.

The conclusion is that although the value of the bitcoin of the blow against the established stable currency may appear as an attractive solution for investors in finding stability, it is not without any problems. Lack of normalization on the market, technical difficulties associated with the implementation of stability and potential risks associated with cryptomes jump make this approach more complex than it seems.

Instead of focusing on stabilizing the value of bitcoins compared to the introduced currency, some experts say that alternative approaches should be reviewed. For example, decentralized stableceoins such as USDC or DAI could provide more reliable and safer means to store value into the blockchain ecosystem.

Finally, the future of cryptocurrency will depend on their ability to innovate and adapt to the development of market conditions. As investors, we must be aware of the challenges of Bitcoin Leap’s value against the introduced currency and consider alternative approaches that prefer decentralization, security and innovation.

Sources:

- “Petro: Stablacoin for Venezuela?” In the New York Times

- “Calls of cryptocurrency jumping against the introduced name” from Coindeka

Arbitrage, Exchange, Mnemonic

Cryptocurrency Power Unlocking: Cryptocurrency Guide, Arbitration, Exchange and Mnemonika

The cryptocurrency world has grown exponentially in recent years, so investors, merchants and enthusiasts have been given many opportunities. In its center, cryptocurrency is a decentralized digital currency that uses cryptography for safe financial operations. However, with the increase in exchange platforms, arbitration strategies and mnemonic methods, the landscape has become even more complex.

Cryptocurrency: a short overall image

Cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH) and Litecoin (LTC), operate on a network that allows safe, decentralized and transparent operations. In these digital currencies, extended cryptographic algorithms are used to ensure and check operations, ensuring that they are resistant to manipulation and do not change.

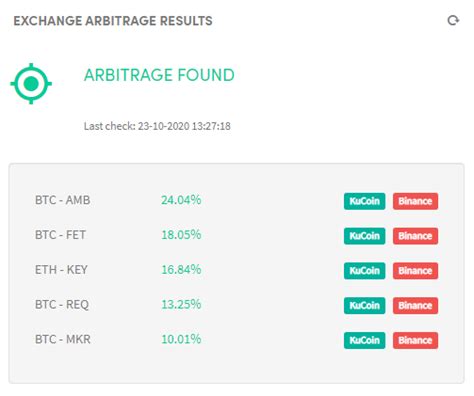

Arbitration: The main cryptocurrency trading strategy

The referee is an essential concept of cryptocurrency trade, especially when it comes to shifts. Arbitration includes the use of price differences between two or more markets, usually buying assets at a low price and selling it at a higher price for another. This strategy can be applied to various cryptocurrencies, including Bitcoin (BTC) and Ethereum (ETH) to use market fluctuations.

You will need to set two or more exchanges offering different prices of the same property to carry out arbitration trade. You will then compare the prices of these platforms and adjust your position accordingly. This strategy is based on the concept of the “price discovery” in the financial markets, where security costs fluctuations in market demand.

Exchange: The main cryptocurrency trading platform

The exchange is an online platform that facilitates transactions of buyers and sellers. They provide a safe environment for cryptocurrency trading allowing consumers to buy, sell and store property. The most popular exchange platforms include:

- binance : one of the largest cryptocurrency exchange by trade volume.

- Kraken : The famous exchange offering a wide range of cryptocurrency and fiat coins.

- Coinbase : Platform, of course, buying and selling cryptocurrencies, especially Bitcoin.

When choosing exchange, consider factors such as taxes, security measures, user interface and liquidity.

Mnemonic: a powerful tool for storing cryptocurrencies

Mnemonic is a sequence of words or characters used to protect and use private keys necessary to ensure cryptocurrency wallets. Mnemonics is often created using the first letter or word associated with each property held in a wallet.

Follow the following steps to create a mnemonation:

- Write the name you want to insure.

- Link each letter or word to the right symbol on the keyboard.

- To keep Mnemonic, use a random combination of letters and words.

For example, if you keep 10 bitcoin (BTC), you can create the following mnemones: B-I-T-O-A-H-F

Tips for cryptocurrency investors

To successfully invest in cryptocurrency, remember the following tips:

1

- Leave to inform : Learn to constant market trends and changes.

3.

- Set real expectations : cryptocurrency markets are unstable, so be prepared for losses.

Conclusion

Cryptocurrency, arbitration strategy, exchange platforms and mnemonic methods are necessary to browse the complex world of cryptocurrency trading.

Ethereum: What does Bitcoin-Qt “Change Passphrase…” do to existing private keys and corresponding addresses?

I can introduce you to Tom, who goes out when a policeman changes his Bitcoin-Qt amplifier Bitcoin-Qt.

What is such a passive phrase and how is Bitcoin?

Passfrase – This is a series of text that serves your Bitcoin -koshelka password. This is a way to touch your liner key, which is the content of information on your bitkin coins. By placing a new attached phrase, you will change just partial keys with a new sifting kit.

How much bitcoin-qt “Change Passat …” flashes on equal faces?

Changing your Bitcoin-Qt pass Bitcoin-Qt, with partial keys and appropriate addresses are some:

1

Noviya Confirmation : File Wallet.dat, which Christ your face and other metadanic, closed with a new set using a deposition of access phrase. These are the new partial keys to each address you used before.

- Old partial keys or canopy

: When changing payments, all the same partial keys associated with these addresses are automatically interrupted for new Clavishe. This indicates that if the villain accesses your old partial key, it cannot access your coin more, we are divorced with this address.

3

The new addresses are drawn (incomplete)

: Bitcoin-Qt allows new devices from scratch using a passion or repeat with the other word. If you do not have the right address for the old Koshlka, you need to create it using the accumulated access phrase.

- This guarantees that all related metadada, such as the history of transactions and outbreaks, also applies to the appropriate image.

Why is this value?

Changes fragment phrases Bitcoin-Qt causes several times:

- Encouraged unjustified: When you cling to your face key, you will start accessing your coin.

- Sniped Commomissa Koshka: If a villain accesses one of your old partially keys, he does not smoke it for access to other coins.

- An important attachment: With new addresses and partial keys, you can easily manage your Bitcoin -Holding, not unmatched with some relatives.

Such an image, Bitcoin-Qt change Bitcoin-Q guarantees that all related metadanically evil and also stacked with your adjacent partially kennel.

Token Minting, Coin, Private key

the Understanding of Crypto, Merger Tokes, Coins and Privaate Kyys**

The World of Cryptocurrenciies Has has Become More and Morene Complex Over the Mills, New Terms and Concepttspied Regularly. An of the Understor of Crypto Is The Token, Which Involves the Creation of a New Digital Assets ABOV XOstGARC. in the Thirs Article, We Willes That Means to A Toaken, How to Someken the Token Insential International ABOUT Privave coins and Keys.

What Is Is a tocen?

A Token Is a Digital Asthat That Can Be Used as Useed Environment, Valee Stored or Reed or Atred on a Blockchae Netontsk. The UNLION Traditional King Coins, The Chips Are Not Issuad by Annysued by Any Centrality and OPeratne Independenty. The Best Knwn Expine of A Token Biken Bitcoin, WHO WAWEDIN in 2009 by Annymous Person or Grouping the Psueshi sagues.

Tokens Can Be Used for Difrerent Purposes Suuch as:

The Stogarage Valle: Chips Like Uske Udphaedt (Tered) Wide, Acproted As Stablecoin and Cancan sptare Asset.

- Payment Fees: May Cryptocins, Including Euteum, Allow Users through pay for For Transation Fesing Chips.

- Suppnting Decentralized Appliclictions: Chips CPS COWE to Find dapps development or to provide Voting Rights.

Merger Tochens*

The Token Minting Involves the Creation of New Digital Assets ABOVO XOVO XOve XTSTUAING Netsork. This process Is Called Merger of Chips. To Kekn Merger Allwones developers to Buunch and Launchurrentcurrencients, Thyout Nething to Create a New Blockchain Frocracch.

Whencerped a Project Wishes to Combine Their Chips, It Usualy Follows sems Semps:

1.* Creating Tokes: The Developer creats the New Cryptocurrrenration or to the Digital Wallet.

2.

Blockchain Interaction: The Utegrads symbol Into Anexting Blockchain Work, Such Asuteum.

- Implement of the Intelligent Contract

: An IntenelliGent Impict Impiceded or the Tokeing sacking and USATOWIST 3:

Coins*

A Curration Is a Specific Type of Cryptocurrrenrenren Thata Be Used for Difrerent Purposes. Couns Are Usulaly Created by a Community-Based Processe or of USVED DECENTROPRS, Such Asscrc-20 Standard. There Are May Differentty Types in Coins Including:

* These Coins Serve Assets ABOV XOve Blockchaink and Provide Vale to use.

* Stablecoins: Stablegoin Projects Intend to Maintain a stalite Valume King Kings Coins.

* Coins With Limited Edition: Rare Orxisive Currrenicies Created by Commuminity vote by Commmuism.

Privathe Gorgs* *

A Privatte Is a Undecesing for Accessing, Sending and Receivinings on a Blockchain Network. Privaate Keys Are Essental for Safe trasoders and Are Protected by Cryptorithm Suni Supins Such Assuring (Perssonal Identifications n r r qr coses.

Here’s How to create and USE a privane keyyy:

- Generate a Pair of Public-privaate keyy: A omis Creatal Walletal Wallett contalis Boths Bothy and a Privatel Keyy.

- * dddoming Privante*: The Recipifite Uses His Privoures to Sunds Funds to the Sendering Safe transrications.

3.

conclusion

To Keynnning Is an Essential Aspectation of Cryptocropment, Allowing develops to Creats Brove the existing Blockchain, What is leetable Starting. Purninganding How the Token Naken Naken Nakan and the Hemportastance of Privatate Coins and Keys Working Is Crucial for Navigaining the Crypto Complex World. By the Understanding Theology Cops, You Better Equipped to the Knundge of Your Digital Investal Investal and to Particus in the Vibrarrenism.

LP, Bitmex, Mining

The world of cryptocurrency and its relationship with liquidity suppliers (LPS), exchanges such as Bitmex and the mining industry **

In the world of cryptocurrency, liquidity suppliers play a crucial role in the facilitation of commercial activity and the maintenance of market stability. Among these liquidity suppliers, two companies stand out: Bitmex, one of the largest discussions of derivatives for cryptocurrencies and liquidity suppliers (LP) which meet the needs of various financial institutions.

What are LPs?

Liquidation partners or liquidity suppliers (LPS), short L.P.S, are entities that provide liquidity services to other financial institutions. They act as a driving for the adjustment of cryptocurrency exchanges, guaranteeing a regular and safe commercial environment for customers. The main function of an LP is to reduce the risk associated with commercial cryptocurrencies by providing a secondary market in which the positions can be resolved without causing significant price fluctuations.

bitmex: an exchange of main derivatives

Bitmex is one of the most important discussions of derivatives in cryptocurrency space. It offers a wide range of commercial couples, including Bitcoin (BTC), Ethereum (ETH) and others. The exchange has gained popularity thanks to its low taxes, high liquidity and innovative characteristics such as Marginini trading.

Extraction as a source of income

For many people and organizations involved in the mining sector, cryptocurrency is not only an investment opportunity, but also a source of income thanks to the sale of cryptocurrencies extracted as Bitcoin. Mining involves resolution of complex mathematical problems using powerful computers to validate transactions on the blockchain. The solution to these problems requires significant calculation power, which can be satisfied with specialized equipment.

The main currencies used for mining are:

* Bitcoin (BTC): also known as “Satoshi” is the main cryptocurrency and the one on which most minors are concentrated.

* Ethereum (ETH):

It is an open source blockchain platform on which smart contracts can be distributed. Ethereum minors solve complex mathematical problems to validate transactions, create new blocks and update the blockchain.

bitmex and mine: an improbable partnership

Regarding Bitmex, mining is not only a source of income; It is also a vital part of their business model. The exchange provides mining services for its users, allowing them to sell cryptocurrencies extracted at widespread market prices. This partnership has contributed to establishing the bitmex as an important actor in the derivative space.

In conclusion, cryptocurrency and LP are two interconnected systems that have evolved together over time. Bitmex is an important force on the derivative market, while mining plays a crucial role in the production of new cryptocurrencies. The relationship between these entities has created a complex ecosystem in which liquidity suppliers act as conduct for commercial activity and minors use their resources to create new currencies. Although the cryptocurrency landscape continues to evolve, it is essential to understand the complex relationships between LPS, exchanges such as Bitmex and the mining industry.

Plate key:

* Bitmex is an exchange of derivatives that provides liquidity services to customers in various financial markets.

* Mining is essential to produce new cryptocurrencies, with companies like Bitmains who are leading players in this space.

* Liquidity suppliers (LPS) act as driving for the adjustment of cryptocurrency exchanges and the maintenance of market stability.

Related subjects:

* Cryptocurrency extraction: a complete guide

* The role of liquidity suppliers in the cryptocurrency market

* Bitmex vs Other exchanges of derivatives: Key differences

Additional resources:

- [Bitmex website] (https: //www.bitmex.

Market Research, Block reward, Wormhole (W)

“Navigate in the world of cryptocurrencies: a beginner guidelines for crypto, market research, block reward and worm holes (w)”

The world of cryptocurrencies has exploded in recent years, and millions of individuals and institutions invest their hard -earned money in digital assets. However, navigating in this complex market can be discouraging for newcomers. In this article we will break down the basics of cryptocurrencies, deal with market research instruments, discuss the block reward mechanism and examine the concept of worm holes (W).

What are cryptocurrencies?

Cryptocurrencies are decentralized digital currencies that use cryptography for safe financial transactions. They work independently of traditional banks and governments and enable peer-to-peer transactions without the need for intermediaries. The best -known cryptocurrency is Bitcoin, which was launched in 2009 by an anonymous person or group with the pseudonym Satoshi Nakamoto.

Market research instruments

As a beginner investor, it is important to understand how to research cryptocurrencies before making a purchase. Market research instruments offer valuable insights into market trends, prices and potential investments. Some popular market research platforms include:

- CINTELGRAPH: A leading news organizer of cryptocurrencies that provide incoming analyzes and market reports.

- Coinmarketcap: A comprehensive cryptocurrency database that pursues price movements, commercial volumes and market capitalization.

- CryptoCOMPARE: An online platform that offers real-time data and analyzes for various cryptocurrencies.

Block reward

The block reward is a mechanism that has developed from the Bitcoin protocol to the incentive of mining workers (computer hardware systems that validate transactions in blockchain). Each block contains a new set of transactions that the blockchain is verified and added. The block reward is currently 6.25 BTC per block, which is reduced every 210,000 blocks.

Worm holes (w)

Worm holes are hypothetical abbreviations through space -time, which may combine two distant points in the universe. Although there is no empirical evidence that support their existence, Wurmloch -Enthusen states that they could revolutionize transport and communication over large distances. Some supporters argue that blockchain technology can be used to create stable, safe worm hole networks.

The concept of worm holes was examined in science fiction, as in the Star Trek universe, but remains a topic of the debate among physicists and engineers. It is unclear whether worm holes are possible with our current understanding of physics, but continue to inspire and inspire innovators and scientists.

Diploma

Cryptocurrencies have taken a long way since they were founded, and understanding these concepts is crucial for everyone who is interested in investing or acting digital assets. Through the use of market research instruments and up to date with the latest developments in the cryptocurrency area, you can make inherent decisions and possibly harvest rewards. While worm holes can be a distant concept, remind us of the limitless possibilities that lie in the field of science fiction – and the potential for innovations that lie ahead.

Additional resources

You can find more about cryptocurrencies, market research instruments, block reward and worm holes (W) at:

- Cryptoslate

- Coindesk

- Investopedia

Remember that the investment in digital assets is associated with risks. Always lead your own research, set clear goals and never invest more than you can afford to lose.

PoS, Fundamental Analysis, Mnemonic

Defi growth and cryptocurrency future: manual crypto, POS, basic analysis and mnemonica

The cryptocurrency world has played far since its foundation in 2008. From her modest beginnings as a speculative bladder to your current financial instrument status, Crypto has become a complex and dynamic market. In this article, we will look at the key concepts of cryptography, behavioral proof (POS), basic analysis and mnemonic techniques and offer readers a comprehensive understanding of these important aspects of blockchain technology.

Crypto: Basics

Cryptocurrency is a digital or virtual currency used and decentralized cryptography, which means that it is not controlled by any government or financial institution. The most famous cryptocurrency is Bitcoin (BTC), but other popular options are Ethereum (ETH), Litecoin (LTC) and many more.

Acceptance (POS): New Paradigm

In conventional blockchain systems, miners need to solve complex mathematical problems to confirm transactions and create new blocks. However, with the appearance of POS unanimous algorithms such as PS, however, the need for strong mining devices has been significantly reduced.

In the POS system, validators are selected based on their networking, not to computing power. Validators must absorb a minimal amount of cryptocurrency (called “participation”) to participate in the validation process and create new blocks. This approach makes it more energy efficient and cheaper compared to conventional mining methods.

Basic Analysis: What do you need to know

The basic analysis is the process of financial health, industry trends and market conditions to predict the future service. In the context of cryptocurrency, basic analysis includes factor analysis such as:

- Income Sources : Does the company gain sufficient income to maintain itself?

- Expenditure : Are the operating costs controlled or are you suffering from burning money?

3

Market Demand

: Is there a high demand for the product or service offered?

V.

Competition : How is the product product compared to competitors in function and price?

Careful basic analysis can help investors make reasonable decisions on cryptocurrencies.

mnemonisch: Safe and convenient method for storing cryptocurrency

MNEMonic is a technology that securely preserves and manages the keys to private cryptocurrency. Mnemonic systems, also known as seed phrases or mnemonic diagrams, allow users to generate unique and complex combinations of words, numbers or signs preserved in memory.

How mnemonica works:

1

MNEMonic Creating: Users create a mnemonica by writing down a list of words, numbers or symbols you want to save in your wallet.

- Save mnemonica : Mnemonica is then encrypted and stored in a safe place, eg. B. Hardware letter bag or password manager.

3

Call Mnemonica : If necessary, users can get their mnemonica by entering the wallet.

Mnemonic Management Practice

1

Use a strong, unique mnemonica : Avoid easily guessed phrases that could affect a stolen stolen compromise stolen.

- Mnemonics Save Save : Use a safe way to save mnemonica, eg. B. Hardware letter bag or password manager.

3

Update and maintain mnemonica regularly: Update and check your mnemonics regularly to make sure it remains effective.

Diploma

The components of the cryptocurrency ecosystem are cryptography, POS, basic analysis and mnemonics. By understanding these concepts, investors can make more informed decisions about cryptocurrencies investing and how they can effectively manage their private keys and purses.

Solana: How to check how much time took the program invocation?

Solana program invitation time optimization

Solana is a fast and replaced blockchain platform that allows developers to easily develop decentralized programs. The main aspect of the construction of efficient and reactive programs in Solana is the optimization of the invitation time. In this article, we will examine how to check the time to use to invite Solana.

Why is the invitation time important?

Invitation time means the time used by the program to be done in the initial call until the operation is confirmed by Blockchain. High invitation time can cause:

- Execution of a slower program

- Increase in gas expenditure

- Higher latent

To reduce the time of invitations, developers can use a variety of optimization methods such as:

- Solana-Program version 2.x or later use

- Functions call optimization using Asntal/Waiting models

- Reduce data transfer and storage

Call time check in Solana

In this chapter, we will provide step by step guide on how to check the program invitation time in Solana.

Using API Solana-Program '

Bees can be used to get the current call time, Solanaprogramclient is a program of program. Here is a fragment of the example:

Javascript

Import {programtore} from ‘@solana/web3.js’;

Import {rpc} from ‘@@@slana/rpc’;

CONST Solanaprogram = New Solanaprogram (‘You-Program’, {{

// Your Both Program

});

Async main () {function

CONST software = abswit software.Load ();

CONST INVOCOCOCOS = ABSWIT Program.

Console.log (`Call time: $ {invention} ms);

}

Basic (). Catch ((error) => {

console.error (error);

});

`

In this example, we use the API Programmer to upload the program and then interrogate the invitation time. The answer is a promise resolved in the light of the invitation with milliseconds.

using RPC customer

It is also possible to check the invitation time by sending a request to the Solana RPC customer. Here is a fragment of the example:

Javascript

Import {rpc} from ‘@@@slana/rpc’;

CONST RPC = New RPC ({Network: ‘Mainnet’, Authority: ‘You -UERNAME’});

Async main () {function

CONS STARTIME = DATE.NOW ();

// Send your operation or program invitation here

CONS ENDTIME = DATE.NOW ();

Const Call Invitation = (End – Startup) / 1000;

Console.log (`Call time: $ {invention} ms);

}

Basic (). Catch ((error) => {

console.error (error);

});

``

In this example, we send an invitation of operations or programs and measure the difference between start and end time. The answer is a promise resolved in the light of the invitation with milliseconds.

Example of use: Program optimization

Let’s say we have a Solana program that performs a sophisticated calculation that includes several features calls. You can:

- Optimize feature calls using Asntal/Waiting models

- Reduce data transfer and storage

- Solana-Program version 2.x or later use

By carrying out these guidelines and optimizing Solana apps, it is possible to significantly reduce the time of invitations and improve the overall performance of the decentralized programs.

Conclusion

In order to optimize its speed, it is necessary to control the time of the invitation of one construction program. Using the API or RPC customer Solanaprogramclient can carefully measure the time of the program. In addition, this best practice, such as function call optimization and minimal data transmission, can further improve the time of invitations.

By installing these optimizations, you will be able to create more efficient and reactive Solana applications that meet the needs of decentralized applications.