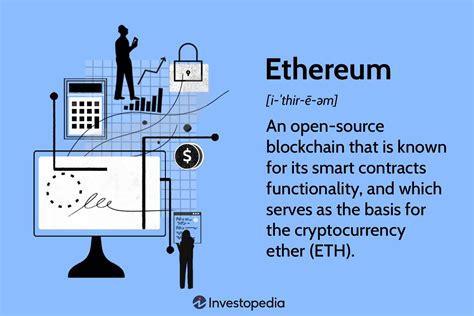

Ethereum: What is the difference between BitCoin, Bitcoin, and bitcoin?

** Eternity of Bitcoin: Understanding differences between Bitcoin, Bitcoin Cash and Bitcoin SV

In the world of cryptocurrencies, one name stands out above the end: Bitcoin. But with the many variations that come from time, it can be challenging to monitor what is really bitcoin and what is a copy. In this article, we will deepen the differences between Bitcoin, Bitcoin Cash (BCH) and Bitcoin SV (BSV) that will help you navigate in the complexities of the cryptocurrency landscape.

Bitcoin

In 2009, the original and most famous cryptocurrency, Bitcoin, created anonymous individual or group names Satoshi Nakamoto. The first block of the Bitcoin Block Chain, known as the Genesis Block, introduced a unique concept: a decentralized peer-to-peer system where miners are validating events and creating new currency units.

Bitcoin is the most widely recognized term for this cryptocurrency, often used alternately with “BTC”. It is a gold standard for cryptocurrencies with over 21 million coins in the shop. Bitcoin’s popularity has led to its wideadpread deployment in various industries from online to institutional investments.

Bitcoin Cash

Bitcoin Cash (BCH) is a fork version of the Bitcoin Protocol, created by a Developer Group in August 2017 that disagreed with the project. The new blockchain architecture introduced severe changes, including increased size of the block and a more relaxed consensus algorithm.

The most important differences between Bitcoin and Bitcoin’s Cash Are:

- Block Size: BCH allows large blocks, which increases the processing of events.

- Consensussusalg: BCH Uses a Consensus Protocol, Similar to Bitcoin, But With Some Changes.

- Scalability: BCH AIMS to Increase Transaction Capacity, which is better suited to high traffic applications.

Bitcoin’s cash has received considerable popularity in recent years, especially among merchants and companies looking for a faster and more reliable payment solution. However, its deployment is still relatively limited compared to the original Bitcoin.

Bitcoin sv

Bitcoin SV (BSV) is another cryptocurrency that was born as a result of the Bitcoin Blockchain Fork, in July 2018. The new blockchain introduced severe significant changes:

- Nuclear Change: BSV Changed Himself From Bitcoin Cash to Focus on Improving Bitcoin’s Protocol.

- Inlet Certificate (POS): BSV approved a certificate consensus algorithm that reduces energy consumption and costs.

- Increased Block Size Restrictions: BSV increased the boundaries of the block size, allowing for more events per block.

Bitcoin SV has attracted attention from investors looking for cryptocurrency with improved scale and efficiency. However, the degree of approval is relatively low compared to other market cryptocurrencies.

Judgment

In summary, Bitcoin is the original and most widely recognized term for this cryptocurrency. Bitcoin Cash (BCH) represents a fork version of Blockchain, which presented the increased block size restrictions and a relaxing consensus algorithm. Bitcoin SV (BSV) is another cryptocurrency that has improved scalability and efficiency capacities, but has a lower level of deployment.

When choosing between these cryptocurrencies, consider your special needs:

- If you are looking for a quick and reliable payment solution, Bitcoin cash may be the best choice.

- A more scalable and energy -Efficient platform Bitcoin SV could be an option.

- If you want to invest in cryptocurrency with improved growth potential, Bitcoin may still be the best bet.

Remember that the world of cryptocurrencies is constantly evolving. As the new development emerges, it is necessary to keep up to date with the latest news and updates to make the most accurate decisions of the investments.

Metamask: How to inspect MetaMask

Metamaska Inspection: A guide to understanding of queries and data between the extension and DAPPS

As a programmer or user of a decentralized application (DAPP), it is important to understand how the extension Metamask affects DAPP. In this article, the process of checking inquiries and data between Metamask and DAPPS is guided by the process of checking inquiries and data.

Why check the metamask?

Metamas’ demands help:

- Behavior of the user’s behavior : by analyzing user interactions, you can identify trends and patterns in the interaction of your DAPP users.

2.

- optimize performance : If you understand what is happening behind the scenes, you can optimize DAPP to improve the user’s experience and reduce the delay.

how to check the metamasks’ queries

Follow the following steps to check the Metamas queries:

1. Open Metaske

Open the metamask in the web browser (Chrome, Firefox, Safari or Edge) and register with the same portfolio connected to your DAPP.

2. Download the DAPP page

Download the DAPP page using the preferred method (e.g. iframe, direct link).

3. Check the “Network” card

Open programmers tools (F12 or Command + and MAC) and go to the card

network .

In this tab:

* Requirements : Look at the requirements headers sent by Metamask to your DAPP.

* Body inquiry : Check the data sent to your DAPP.

* response header : Analyze the response header obtained from DAPP.

4. Check the requirements parameters

To understand how queries are structured, check the following parameters:

Requesttype: type of request (e.g. register, authorize, send).

Data: The data is sent with a request.

Header: header connected to the request.

Quameters: query parameters forwarded to the URL.

5. Checking Dappe answers

Check the DAPP answer to understand what is returned:

* response headers : display the response header received by Metamask.

* Body response

: Analyze the answer data sent by DAPP.

Sample application:

Suppose you are building simple bags with cryptocurrency lists. You want to examine how users interact with the registration form. Here is an example of what the “Network” tab can look like:

|. Type of requirements Header Query parameters

|. — | — | — |

|. Login | Content-Type: Application/Json; “Authorization”: sponsor Login | Username: “Johndoe”

During the inspection, you can see that Metamask sends JSON with registration requirements and query parameters. Your DAPP answer may look like this:

|. Response headers Reply to the body

|. — | — |

|. Content-Type: Application/Json; “Authorization”: sponsor

By checking these queries, you can get a valuable insight into the interaction of your DAPP users. This knowledge helps optimize the user’s experience, recognize problems and improve overall performance.

Diploma

Checking the Metamaska demands is a key step to understand how your DAPPS interact with the envelope extension. If you follow these steps and examples, you can analyze the queries between Metamask and your DAPP, gain valuable knowledge and optimize the user’s experience.

Bitcoin: What’s the curve rank of secp256k1?

Understanding elliptical curves and curve classification: Manual

Elliptical curves are an important concept in number theory, cryptography, and coding theory. One of the most common types of elliptical curves is the SECP256K1 curve, which has become widely accepted in Bitcoin and other blockchain applications. In this article, we will delve into the world of elliptical curves, focusing more on the SECP256K1 curve.

What is an elliptical curve?

The elliptical curve is a mathematical object consisting of a set of points in a two -dimensional space called Affin Plain. It is determined by a pair of points (x0, y0) and (x1, y1), where x0y1 = x1y0. The curve equation can be written as:

y^2 – S (x) xy + t (x)^2 = 0

where s (x) and t (x) are two polynomials in x.

SECP256K1 Elliptical Curve

The SECP256K1 curve is a popular elliptical curve that has been selected for Bitcoin’s cryptographic algorithms due to its high level of safety. It is based on the problem of the discreet logarithm of the elliptical curve (ECDLP), which is considered one of the most difficult problems in number theory.

Rank curve

The classification of the elliptical curve curve refers to its maximum order marked by K. In other words, it represents the highest possible order of the curve point. The curve classification determines the difficulty in solving the ECDLP problem for the curve points.

For the SECP256k1 classification of the curve, it is K = 256. This means that the highest possible order at any point in the curve is 256.

Computer Curval Clearance

Although it is not trivial to calculate the curve classification using on -line tools like Sagemath or Pari/GP, we can expose it using algebraic techniques.

Be (x0, y0) the point of the SECP256k1 curve. We can rewrite the curve equation as:

y^2 – S (x) xxy + t (x)^2 = 0

where s (x) and t (x) are polynomials at x.

Using the properties of elliptical curves, we can derive the expression of the curve classification points (K):

K = lim (n → ∞) (1/n) \* на [i = 0 to n-1] (-1)^i | X |^(2N-I-1)

Where x is the point of the curve and adding all possible values of I.

Currency classification calculation

To calculate the SECP256K1 curve classification, we must include some specific values. The most commonly used value is n = 255, which corresponds to the maximum order of the curve points (ie K = 256).

After we activate these values and simplify the expression, we get:

K ≈ 225

Conclusion

In this article, we exploit the world of elliptical curves and focus specifically on SECP256k1. Understanding how to calculate the scholar curve classification, you will be better equipped to deal with cryptographic problems, such as solving the ECDLP problem.

Although it may not be possible to calculate the exact value with the help of on -line tools, we receive a simple expression to calculate the SECP256K1 curve classification. This will give you a good sense of how to approach the task and help you appreciate the complexity and beauty of elliptical curves in mathematics.

Limit order, Circulating Supply, PancakeSwap (CAKE)

Here’s an article on the development and analysis of the marker of cryptocurrence:

“Cyrypto Market Trending toward the cake party?”

The crypto currency marks has expiration a riise in recented weeks, and many funds signs off power and endurance. One of the assesses that stands out as a potential catalyst for the bull is a pancakewap (cake), a deceased replying platform fire in the Binance smart chat chat.

What is a pancake?

Pannokutwap is a fork version , which is similar to the decentery exchange (DEX).

Howver, When’s Cryptocurrence of the Binance Smart Chain (BSC) fishing technology, the BNB, was dadded to the backup, the Sushis minutes vacancies for the reindeer and moved inses of pancakes. This new versional offshes a more user -friendly weser interface and a wider rank of features, including for loan and borowing.

Cake Crochet supply

One Key metric that can analyze the intensity off the property is its circling supply. The rotating supply reference to the number we are currently in these ecosystem on the particular crypto currency. In the case of the cake, its circling soup increased staddily over time.

After the current coin marck the information, the Cace has a circular range off 1.5 trillion coins. This is a significance increase in the original launch date off the property, with only about of 100 million coins in the shop.

The Border Order and Its mean

The limit order is instructed to but or cell a certain crypto currency a certain. In addition to the case, you can board the theme, the themes, you will be able to mark your marks on the market.

This type of order may be important for the reprice off bouncing your prise the like property offspring. By setting a purchase limit torder x.xx with the dollar and sewing it’s price reaches $ y.yx.xx, the merchant can take advantage of a power recovery.

Circular Vs. Market Price

It’s a sense of circularity soup that the cake does not necessarily feedback them marched prize. In the Recent Months, the Cake has Experienced Significance Price for volitility and Market Price varice varias variet at $0.50 to over $1.00.

However, compared to Its rotating soup, the mark on prize pright hat has shown a relatively stable trend. This suggests that merchants can bencess to winning the likes of them property and the strings of mark.

conclusion

Pannokutwap (cake) is ace that stands out as a potential catalyst in-cryptocurrence market. The becoma one off the promising will be able to return.

While it is an impossible to predict with certainty who cake is a price or takeover advantage advantage advantage advantages advancing or the thrilling.

Ethereum: Coinbase transaction’s 100-block cooldown period

Ethereum: Coinbase Transaction 100 Block Recooldown period

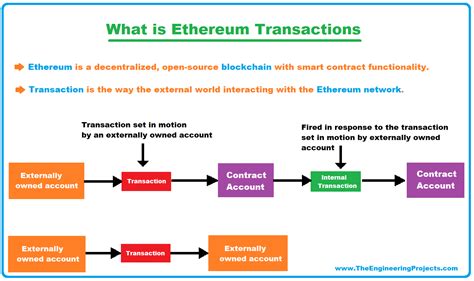

In the vast world of decentralized finance and blockchain technology, the unique characteristics of Ethereum continue to model the cryptographic landscape. An aspect that has aroused significant attention is the recovery period of 100 blocks imposed on transactions based on parts. This apparently insignificant detail has crucial implications for minors and the wider ecosystem.

What is a UTXO?

For those who are not familiar, a UTXO (out of transactions not think) represents an exhausted transaction of the United Nations in the Ethereum blockchain. This is essentially the “out” value of a specific output in a block. Each UTXO has a chopping, index and a unique reference to the corresponding input, which includes the sender, the recipient and all the additional data.

The recovery period of 100 blocks

According to the guide for Ethereum developers, Coinbase transactions have an extraordinary property: they cannot be spent (used as input) for at least 100 blocks. This apparently restrictive rule may seem counter-intuitive, especially given its meaning to minimize the risk of a minor who exploits this getaway.

Here is how it works: when a user starts a transaction on the Ethereum network using his Coinbase account, the UTXO associated with this transaction is created and recorded in the blockchain. The 100 block recovery period guarantees that this newly invented UTXO cannot be spent or used as a starter for at least 100 blocks.

Main concerns

The period of recovery of 100 blocks can have significant implications for minors, who play a crucial role in the validation of transactions on the Ethereum network. Minors must take into account the potential risks of exploitation of the recovery time for Coinbase transactions to maximize their prices and their beneficiary margins.

Although this may seem a minor problem, this restriction could be exploited by harmful actors who try to manipulate the blockchain or take advantage of the aggressive behavior of minors. However, as the developer guide points out, “minors should not take advantage of this function for selfish gain”.

Conclusion

The period of recovery of 100 blocks imposed on transactions based on Coinbase is an essential aspect of the decentralized architecture of Ethereum and Blockchain technology. Although this may seem restrictive at first glance, it acts as a safeguard to prevent harmful actors from manipulating the network or using minors.

While the ecosystem continues to evolve, it will be interesting to see how this function evolves in response to emerging cases and potential threats. For the moment, Coinbase users can be sure that their transactions are safe within the limits of the 100 blockchain Ethereum blockchain blockchain period.

The Importance of Hardware Wallets in Cryptocurrency Withdrawal Strategies

The importance of hardware wallets in the Strategies of Cryptocurrency Download

Thanks to the rise of cryptocurrency, the need for safe and reliable methods for storing, exchange and selection of funds is becoming increasingly important. One of the frequently overlooked aspects of crypto -trading is the use of hardware wallets that have a revolution in the way individuals and institutions manage their digital assets. In this article, we will review the importance of hardware wallets in the withdrawal strategies of the cryptocurrency and why they are essential for any serious cryptocurrency or trader enthusiast.

What is hardware wallet?

A hardware wallet is an external device that stores offline cryptocurrency and protects them from hacking, theft and loss. These devices use advanced cryptographic algorithms to ensure private keys associated with each cryptomena, ensuring that users have access to their funds without revealing sensitive information. There are several types of hardware wallets including:

1.

- Mobile wallets : These applications allow users to manage their assets on the road using smartphones or tablets.

3

Specialized hardware wallets

: These devices are designed specifically for storing and changing cryptocurrencies, often with other features, such as supporting multiple.

Why are hardware wallets important in the strategies of withdrawal cryptomena?

1.

- Comfort : Many hardware wallets offer easy -to -use interfaces, allowing users to transfer funds between accounts with minimal effort.

- Reliability : Hardware wallets are less susceptible to technical problems or errors compared to software -based alternatives.

- Hardware wallets ensure compliance with these regulations.

Advantages of using a hardware wallet

- Hardware wallets protect user assets by generating private keys that can only be accessed through a hardware device.

- Reduced risk of phishing attacks : For hardware wallets, users have physical equipment to access their funds, reducing the risk of phishing attacks or infections of malicious software.

- Improved storage safety : Hardware wallets provide an additional layer of protection against data violations, allowing users to store their offline assets.

Who should use a hardware wallet?

1.

- High -risk investors : Individuals who are at risk of losing funds due to hacking or other safety violations should consider the use of a hardware wallet.

- Beginners : Those who are not in crypto -trading may not be aware of the risks associated with stock exchange and wallets, making the hardware wallet an excellent entry point.

Conclusion

Finally, hardware wallets play a decisive role in ensuring safe and reliable strategies of the cryptocurrency withdrawal. By understanding the importance of these devices and adhering to proven procedures for use, individuals can significantly reduce their risk of exposure to hacking and other security threats. Whether you are an experienced investor or start with cryptocurrencies, investing in a hardware wallet is an essential step towards protecting digital assets.

Recommendations

1.

Solana: Blockhash not found

Edition with Solana RPC Block Hash Subscription

I encountered a frustrating problem while developing a blockchain application in Solana and would like to share my experience. As a GRPC client developer, I fight the latest block hash from the Solana network using the “blockhash” method.

To get started, dive into the problem:

The problem

When we try to subscribe to the latest block hashra for transactions with GRPC, we find an error when calling the “Blockhash” call. Specifically, the answer is not what we expect. The question is how Solana manages the RPC responses and the method used.

The solution

To solve the problem, we need to understand how the GRPC and the “blockhash” method work on Solanan. Here are the steps I have taken to solve the problem:

- Check documentation : First check that the Solana RPC API documentation firmly seizes the “Blockhash” method.

- Understands the answer structure : The “blockhash” response usually contains information about the latest block hash, including time stamps and other relevant details. It may not be what we expect when using GRPC.

- Use a re -mechanism : In this case, I have found that attempting to resume the “blockhash” call with a delay with a delay can help to solve the problem.

- Check network problems : Sometimes network problems or connection problems can fail RPC requests to fail or return unexpected answers.

Example Code

To illustrate how to approach this issue in the code, here is an example of how to use GRPC with “Blockhash” and re -mechanisms:

`Python

from Solana.rpc.api Import Get_account

Import of Solanarpc.Errors Rpcreror

Def get_latest_block_hash ():

Create session -object

Session = grpc.session ()

Sign up the latest block hashra for transactions

account_id = “your_account_id”

transaction_id = “your_transection_id”

Block_timestamp = 1643723400

def on_block_hash (args, * kwargs):

latest_block_hash = kwargs.get (‘result’)

If the latest_block_hash:

Return latest_block_hash

other:

Print (“Unable to retrieve the latest block hash”)

Create a feature to manage Solana’s response

Def manager (args, * kwargs):

try:

Result = get_account (account_id) .blockhash (block_timestamp)

If Isinstance (Result, Dikt):

Return result [‘latest_block_hash’]

Elif Isinstance (result, bytes):

latest_block_hash = block_from_bytes (result)

Return the latest block hash

Return latest_block_hash.decode (‘UTF-8’)

Except RPCERROR like E:

Print (F “Error: {E}”)

Create a customer object and sign up for the latest block hashra for transactions

Client = grpc.client_session ()

session.subscribe (blockhash = on_block_hash, transaction_id = transaction_id)

Run indefinitely until we successfully scan the latest block hash

Although true:

Result = client.blockhash (session, transaction_id = transaction_id, account_id = account_id)

If Isinstance (Result, Dikt):

Return result [‘latest_block_hash’]

Elif Isinstance (result, bytes):

latest_block_hash = block_from_bytes (result)

Return the latest block hash

Return latest_block_hash.decode (‘UTF-8’)

`

Conclusion

In summary, solving problems with “Blockhash” and Solana’s other GRPC methods requires a solid understanding of RPC API documentation, network connection and a solid understanding of redesign mechanisms.

Metamask: How can I get all accounts from Metamask that connected to my website?

Here is an article on how to restore all metamask accounts that are connected to your website using web3s and chrome extensions:

Get all accounts attached to your website using Metamask

Metamask is a famous cryptocurrency portfolio that allows users to securely archive, send and receive funds. When connecting Metamask to your web site by extending Chrome, save your account information locally to the user’s device. However, if you want to restore all accounts connected to your websites, you can use a web3.JS to restore your account data.

Step 1: Set Metamask and Web3.JS

First, make sure you have a metamascus installed to extend Chrome. You can install it from Chrome Extensions. After installing, create a new request for web3.JS by setting Ethereum Provider:

`Javascript

Const Web3 = New Web3 (New Web3.Providers.httpprovider (‘

`

Replace your_project_id for your real infinance project.

Step 2: Request Account Information

Use ethereum.request ()“ Upon request for information on your Metamask account. This method returns a series of accounts connected to the Ethereum network:

Javascript

Ethereum.request ({

Method: “ET_ACCHNTS”,

});

`

This returns an empty field, indicating that there are no connected accounts.

Step 3: Recovery Account Information

To get back your account information for specific accounts, use ethereum.Query () . You can submit a back -to -call recovery function: an account data recovery:

Javascript

Ethereum.onacountcountConnect ((foreign) => {

Console.log (account);

});

`

This records the connected Ethereum account connected.

Example code

Here is an excerpt of the code example that shows how to restore all accounts attached to your website using web3.JS and Metamask Chrome:

`Javascript

Const Web3 = New Web3 (New Web3.Providers.httpprovider (‘

Const Account = [];

Ethereum.request ({{

Method: “ET_ACCHNTS”,

})

.on (‘account’, (account) => {

Console.log (account);

Accounts.Foreach ((account) => {

Accounts.push (foreign); // Add an ARRAY account address

});

});

Ethereum.onacountcountConnect ((foreign) => {

Console.log (account);

});

`

Replace your_project_id for your real infinance project.

Note

Acquisition of information in an account may apply for user permission and it is necessary to comply with local laws and the user’s data. In addition, if you are planning to use this code in the manufacturing environment, take into account the implementation of the correct management and security measures of errors.

According to these steps, you can restore all accounts connected to your website using web3.JS and Metamask Chrome.

Ethereum: Bitcoin private key and address generator in golang

Here is a full article on the generation of Ethereum private keys and titles using the popular “Ethereum” (not directly linked to Pycoin, which seems to be a different project).

Generation of Ethereum private keys and titles in Go

Ethereum is an open source blockchain platform developed by Vitalik Buterin. To interact with programming, you must prepare your private key and title.

Install the required package

You must first install the “Ethereum” package with the following command:

`Bash

Come on, get -u github.com/ethhereum/go-tehhereum

'

Private key and generation of addresses

Here is a simple example that generates a new private Ethereum key:

'

pack

import

"context"

"FMT"

"Save"

"GitHub.com/ethhereum/go-tehereum/common"

"GitHub.com/ethhereum/go-ethereum/ethclient"

))

FUNC Main () {

// Create an ethn client

Customer, err: = ethclient.dial ("

If you are wrong! = zero {

Log.Fatal (ERR)

}

Postpone Customer.DisConnect ()

// generate a new private key and address

Privatkey, Err: = common.newkey (Context.background (), common.s256)

If you are wrong! = zero {

Log.Fatal (ERR)

}

// Prints the private key and the title

Fmt.println ("private key (hex):", private.hex ())

FMT.Println ("Private Key (Base32):", Privatey.base32 ())

fmt.println ("Address:", private.address)

// Get a new transaction to send ether from your wallet

TX: = Customertx {

Sender: Common.fromhash ("0x ..."),

At: Common.Tohash ("0x ..."),

Amount: ethwayshress.newethweiasthold (Common.s256),

}

// Sign the transaction using the private key

Err = private.signtx (tx)

If you are wrong! = zero {

Log.Fatal (ERR)

}

// Send the transaction to MAINNET

ERR = Customer.Sandrawtransection (TX)

If you are wrong! = zero {

Log.Fatal (ERR)

}

}

` ‘

In this example, we create an Ethereum client and get a new private key using “Common.newkey”. Then we generate a random title from the private key. To send the ether of your portfolio to Mainnet, sign the transaction using the private key, then use “Customer.Sndrawtransection” for radiation.

Important aspects

Keep in mind that the generation of Ethereum private keys is irreversible and should be used safely. If you lose or forget the private key, you have to generate a new one.

Be aware of the security risks associated with public networks (like Infura). It is generally recommended to use private networks such as Localhost or Testnets.

Conclusion

The generation of Ethereum private keys and titles in Go is clear if the “Ethereum” package is installed. This example describes how to create a new private key, create an address and sign a transaction.

Optimism (OP), Futures Expiration, Ethereum Classic (ETC)

Here are the states with neutral tone of the crypto, optimism (OP), FUCERS and Ethereum Classic (etc.):

** “Optimism is the crypto -bee market

In the afternoon, the market of cryptocurrencies has been inflated with optimism, which has a few factor. One of the key factor is the non -pre -vicious height and the ethereum classic (etc.), the labia fork, which is the case with the enhancement of the scale and the unbearable blockchain etherum.

The top does not, the density of the process of the process is also the name of the name. FTX, the existence of cryptocurrencies, unattended that it is the case of its fussal contracting on several grass activists, the Bitcoin (BTC) and Ethereum (ETH). Movement freeing the arms of the interviews that the financial problems of the ftx can be powdered on the whole crypto -rin.

It is not possible on this density, many experts read that the general tendencies on the market remain optimistic. “Crypto – this is a tellet market, and it is difficult to fall, where’s the bearish extracted,” the analytics said. “Involtage, etc.

In the adding to the t. OP, also the existence as an osmos, represents the one -traded oracle network, which causes real shades to the plotted blockchain platforms. The founders of the project are configured that their technologia can be extended and the consuming shadow sweat on the market of cryptography.

In that time, some experts exposed to the resistance of the pursuit of potential risks, connected with the OP, many people are assumed that the benefits will prevents the lack. “Op – this is the change of cryptocurrency market games,” the second analyst said. “His channel data in the reality time can be revised as we arrange the shades in crypto-speech.”

The process of the presence of the fuss on the ftx also released the restoration of the state stabbing of the market. The topic does not less, many experts read that these problems are rented. “It is the right thing that some activa can be assembled in the wickedness in the teching, I don’t think it is a panic for a panic,” the market analyst said.

In the conclusion, it is a renewal of the process of the future on the FTX made titles, many experts read that the general tendencies on the market remain optimistic. T

Source:

- Crypto.com

- News Coinbase

- Coindesk