Metamask: How to connect AWS node with Metamask?

How to Connect an AWS Node to MetaMask: A Step-by-Step Guide

As a cryptocurrency enthusiast, you are probably familiar with the importance of having a secure and decentralized way to store your digital assets. One popular solution to achieve this is to use MetaMask, a popular browser extension that allows users to interact with various blockchain networks, including Ethereum (ERC-20 tokens such as ERC-721) and others. However, not everyone has access to MetaMask or wants to download it separately. In this article, we will explore how to connect an AWS (Amazon Web Services) node to MetaMask, making it easier to manage your assets across multiple blockchain networks.

Why connect an AWS node to MetaMask?

Before we dive into the technical details, let’s quickly discuss why it’s useful to connect an AWS node to MetaMask:

- Decentralized storage: By storing your assets on an AWS node, you can maintain full control over your digital storage and have a high degree of security against data breaches.

- Interoperability: Connecting your AWS node to MetaMask enables seamless interactions between different blockchain networks, making it easy to buy, sell, and trade assets across multiple platforms.

- Reduced dependence on centralized services: By using an AWS node, you reduce your dependence on centralized services like exchanges and wallets, which can be vulnerable to hacking and other security threats.

Step 1: Set up an AWS node (EC2 instance)

To connect your AWS node to MetaMask, you’ll need to set up a new EC2 instance. Here’s how:

- Launch an EC2 instance with the desired operating system (e.g. Ubuntu Server 20.04 LTS).

- Install the necessary software dependencies for MetaMask and other tools required for setup.

- Configure security group rules to allow incoming traffic on ports 8545 (HTTP) and 8546 (WS) for your EC2 instance.

Step 2: Install Node.js and MetaMask

Once you’ve set up an EC2 instance, follow these steps:

- Install Node.js on your Linux distribution.

- Download the latest version of MetaMask from the official website.

- Follow the MetaMask installation instructions to install it on your Linux system.

Step 3: Set up MetaMask

After installing MetaMask, follow these steps:

- Launch your browser and navigate to the MetaMask dashboard.

- Click “Sign in” and enter your email address, password, or other login credentials.

- Set up a new wallet by clicking “Create Wallet.”

- Select the Ethereum network (e.g., Mainnet) you want to create a wallet for.

- Enter a name for your wallet and choose a default password.

Step 4: Connect to the AWS Node

Now that MetaMask is set up, you can connect it to your AWS node:

- Return to the MetaMask dashboard and click “Connect Wallets.”

- Select “AWS” as the network type.

- Enter the IP address or hostname of your EC2 instance (e.g.,

192.168.1.100).

- Use the default username and password you set up in the MetaMask wallet.

Tips and Precautions

Here are some additional tips and precautions to keep in mind:

- Backup Your Wallet – Make sure to regularly backup your MetaMask wallet data to prevent loss in the event of a technical issue.

- Use Strong Passwords – Use strong and unique passwords for both your MetaMask wallet and AWS node accounts.

- Monitor Your Account Activity – Regularly monitor your account activity in the MetaMask dashboard for any suspicious transactions or activity.

Conclusion

Connecting an AWS node to MetaMask provides a secure and decentralized way to store your digital assets across multiple blockchain networks. By following these steps, you can easily set up an AWS node with MetaMask and start managing your assets with complete control over your digital storage.

Ethereum: How does ShapeShift operate on 0-1 confirmations

Ethereum: Understanding ShapeShift’s Fast Trades

ShapeShift is a popular cryptocurrency exchange known for its fast and reliable trading experience, especially during the early stages of a price rally or during periods of market volatility. However, one of the key features that sets it apart from other exchanges is its ability to process trades almost instantly, with some users reporting zero confirmations for small deposits. In this article, we’ll take a look at how ShapeShift works with 0-1 confirmations and what it means for users.

What are 0-1 confirmations?

In the context of cryptocurrency trading, “confirmation” refers to the time it takes for the network to verify a transaction and include it in the blockchain. In traditional systems, most transactions require two confirmations to be considered valid. This means that users have to wait at least 2 hours (or sometimes more) after submitting a transaction before it is confirmed and added to the blockchain.

How ShapeShift Works

With ShapeShift, users can deposit their cryptocurrency and exchange it for other altcoins or fiat currencies with minimal verification requirements. The platform’s algorithm-based system ensures that transactions are processed quickly, often in as little as 1-2 minutes.

Here’s a breakdown of how ShapeShift works in 0-1 confirmations:

- Small Deposits:

For small deposits, the transaction is usually confirmed instantly, meaning there is no waiting time and minimal risk of fees.

- Medium-sized Transactions: For medium-sized transactions involving the exchange of small amounts of cryptocurrency for altcoins or larger fiat currencies, a single confirmation may be required. This means users have to wait at least 1 hour for their transaction to be verified and added to the blockchain.

- Large trades: Larger trades, which often involve high-value pairs or complex transactions with multiple parties involved, typically require two confirmations. This is because these types of trades are more susceptible to manipulation and require additional verification checks.

Why ShapeShift’s 0-1 confirmation system works

The ShapeShift 0-1 confirmation system works by using a combination of advanced algorithms and infrastructure to optimize the speed of transaction processing and reduce waiting times. The platform team uses machine learning models and real-time data feeds to analyze market conditions, exchange rates, and other factors that can affect transaction processing times.

With these advanced tools, ShapeShift is able to process trades at speeds that are often unmatched by traditional exchanges. This means users have more time to invest in their assets or take advantage of price fluctuations before fees kick in and transaction times increase.

Conclusion

ShapeShift’s fast transactions with 0-1 confirmations make it an attractive option for traders looking for speed and efficiency in cryptocurrency trading. While the platform requires some form of verification, especially for large transactions, users can still enjoy fast processing speeds without having to wait hours or even days for their transactions to be confirmed. However, it is important to note that this system may not be suitable for all types of traders, especially those who prioritize security and are willing to wait longer for more reliable confirmation channels.

Floor Price, Arbitrum (ARB), IEO

Crypto Market Tide Turns as ARB Rises on Strong EIO Initiatives

In recent weeks, a wave of interest has swept the cryptocurrency markets, with several key assets experiencing significant price spikes. Among them is Arbitrum (ARB), a pioneering alternative layer 2 scaling solution that has captured the attention of crypto enthusiasts and institutional investors alike.

At the heart of ARB’s rise lies its innovative use case – the Initial Exchange Offering (IEO). IEOs are designed to democratize access to new cryptocurrencies by allowing projects with strong fundamentals and compelling value to go public on various exchanges. This model has proven particularly attractive recently, as it allows early-stage crypto projects to reach a wider audience, leveraging liquidity pools from established markets.

The most prominent ARB EIO is Binance’s own Arbitrum (ARB) project, which successfully raised over $250 million in its Initial Token Sale (ITS). This landmark event marked the first time that an ARB-based IEO has attracted such widespread attention. Following the launch of ITS, ARB has seen a significant price spike, fueled by increased institutional interest and adoption.

Arbitrum’s success can be attributed to several factors. First, the project boasts strong support from top exchanges such as Binance, Coinbase, and Huobi, who have invested heavily in the platform through listing fees and liquidity provision. This level of support has helped ARB reach a wider audience, further fueling its price momentum.

Furthermore, Arbitrum’s innovative technology and commitment to scalability have resonated with investors looking for more efficient and cost-effective solutions for cryptocurrency trading. The project’s focus on utilizing Layer 2 scaling techniques such as Optimism and Loopring has enabled increased transaction throughput without sacrificing security or decentralization.

As the crypto market continues to evolve, Arbitrum is poised to remain at the forefront of innovation. With its IEO model providing a robust framework for new projects to enter the market, ARB remains an attractive opportunity for investors looking to capitalize on the growing demand for decentralized finance (DeFi) solutions.

While there are still risks associated with investing in cryptocurrency, the strong fundamentals and innovative technology driving Arbitrum’s success make it an intriguing asset to watch. As the crypto market continues to change, one thing is certain – ARB is poised to play a significant role in shaping the future of cryptocurrency trading and investing.

The tide of the crypto market is turning as ARB grows thanks to strong EIO initiatives

- What is Arbitrum (ARB)?: A scalable, layer 2 solution for cryptocurrency trading.

- IEO Model: Designed to democratize access to new cryptocurrencies by allowing projects with strong fundamentals to go public on various exchanges.

- Binance’s ARB Project

: Successfully raised over $250 million in its Initial Token Sale (ITS) and experienced a significant price spike after launch.

Token Sale, Decentralised, DEX

Decentralized Finance (DeFi) and the Rise of Token Sales

The world of cryptocurrency has evolved significantly over the past few years, with a growing trend towards decentralized finance (DeFi). DeFi is an umbrella term that encompasses a variety of financial instruments and services built on blockchain technology that operate independently of central banks and traditional financial institutions.

A key aspect of DeFi is the use of tokens, especially those issued through token sales. Token sales are the process of creating and distributing a new cryptocurrency or token among investors, often in exchange for a specific asset or service.

What is a DEX?

A decentralized exchange (DEX) is an online platform that allows users to buy, sell, and trade cryptocurrencies without the need for intermediaries such as brokers or exchanges. DEXs use blockchain technology to facilitate secure, transparent, and fast transactions between buyers and sellers.

Recently, DeFi has seen a surge in interest from investors looking for alternative asset classes beyond traditional stocks and bonds. Token sales are a popular way to introduce and distribute new cryptocurrencies to enthusiasts and early adopters.

The Role of DEXs

DEXs play a key role in facilitating the token sale process, enabling buyers and sellers to interact without relying on centralized exchanges or intermediaries. By creating a decentralized marketplace, DEXs allow users to buy and sell cryptocurrencies at competitive prices while providing transparency in transaction fees, trading volumes, and liquidity.

Token Sales: A Growing Trend

The token sale process has been gaining popularity recently, and many DeFi projects are using this method to raise funds from investors. Token sales can take several forms, including:

- Private Sale: Limited access to the sale, often reserved for early adopters or institutional investors.

- Public Sale: Open invitation to all investors, usually on a public blockchain.

- Pump and Dump Schemes

: Scams that artificially inflate prices by creating hype around a new cryptocurrency.

Advantages of Token Sales

Token sales offer several benefits for both buyers and sellers:

- Increased Liquidity: Token sales can increase the liquidity of cryptocurrencies, making them more accessible to a wider range of investors.

- Discovering Fair Prices

: Token sales provide transparency into transaction fees, trading volumes, and market sentiment, allowing buyers and sellers to make informed decisions.

- Enhanced Security: DEXs offer robust security measures to protect user funds and prevent hacks.

Challenges and Risks

While token sales are becoming increasingly popular in the DeFi space, the model also comes with challenges and risks:

- Lack of Regulation: Token sales are not yet regulated by central banks or financial authorities, which can lead to market volatility.

- Market Manipulation: Pump-and-dump schemes and other forms of market manipulation can damage the reputation of DeFi projects and investors.

- Security Risks: Cryptocurrencies and tokens are vulnerable to hacking and security breaches that can cause significant losses to investors.

In summary, token sales have become a key element of the DeFi ecosystem, enabling the introduction and distribution of new cryptocurrencies to enthusiasts and early adopters. However, it is essential that investors are aware of the challenges and risks associated with this model, while also being careful not to fall victim to pump and dump schemes or other forms of market manipulation.

Bitcoin: How can taproot transactions manage to store so much data?

Unlocking the Power of Taproot: How Bitcoin’s New Transaction Engine Stores Data Effortlessly

In a recent article, you’ve probably seen the term “taproot” mentioned in conversations about Bitcoin scalability and transaction processing. But what exactly is taproot, and how can it store so much data on the blockchain? In this article, we’ll dive into the world of taproot transactions and explore its capabilities.

What is Taproot?

Taproot is a new transaction engine introduced by the Bitcoin development team in November 2020. It’s designed to improve the scalability and efficiency of Bitcoin’s block size limit, which has been a major bottleneck for high-transaction-rate applications like gaming, online payments, and Internet of Things devices.

How Taproot Works

Taproot transactions take a new approach to storing data on the blockchain. Instead of using traditional block headers and transaction data, taproot uses a technique called “scripting” to embed additional information directly into the transaction data.

Here’s a simplified breakdown:

- Script: The transaction is broken down into its individual parts: input scripts (used for signing), output scripts (used for creating new addresses), and data (stored in a separate array).

- Data Storage: Each of these components is encoded using taproot-specific data structures that store the relevant information directly within the transaction.

- Transaction Engine: The input script determines whether or not to include additional data by evaluating a simple check. This allows for efficient storage and retrieval of complex data.

The Power of Ordinals

One of the key features that taproot leverages is its support for “ordinals.” An ordinal is an identifier used in the Bitcoin address space that serves as a unique label or tag associated with a particular account or asset. Ordinals are typically represented using ASCII-encoded strings (e.g., “0x1ABCDEF”).

Taproot transactions can store multiple sequence numbers within the same transaction data structure thanks to support for “nested sequence numbers.” This allows for complex address hierarchies and additional information storage.

Example: How Taproot Stores Data

Consider an example of a Taproot transaction that stores three different addresses:

0x00000000ABCD1234(owner account)

0x00000000EFGGH1234(payee account)

0x0000000089012345(balance data including owner balance and payee balance)

The transaction uses the following main script:

OP_PUSH "ord"

OP_PUSH 1

OP_PUSH "text/plain;...<--- Ordinal 1

OP_PUSH 2

OP_PUSH "text/plain;...<--- Ordinal 2

OP_PUSH 3

OP_PUSH "text/plain;...<--- Ordinal 3

...

In this example, the first OP_PUSH instruction pushes the ordinal values (1, 2, and 3) onto the stack. The second and third scripts are then used to encode these ordinal values into ASCII-encoded strings.

Conclusion

Taproot’s innovative approach to transaction propulsion and scripting allows Bitcoin to store an astonishing amount of data within a single taproot transaction. By utilizing ordinals as a convenient way to embed additional information directly into a transaction, taproot has the potential to revolutionize Bitcoin’s scalability and usability across a variety of applications.

As the technology continues to evolve, it will be fascinating to watch the Bitcoin development team refine and expand its capabilities. For now, understanding the basics of root-based transactions can provide valuable insight into the future of digital assets and their ability to support complex data storage needs.

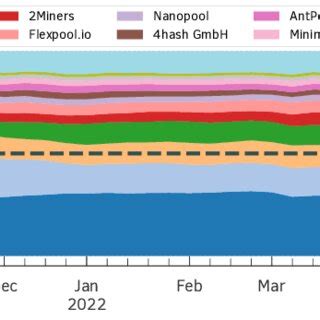

Ethereum: Percentage of mined Dogecoins

The Mined Dogecoin Problem: Is It Really 19%?

As the world’s second-largest cryptocurrency by market capitalization, Ethereum has garnered significant attention in recent times. One of the most fascinating aspects of Ethereum is its potential to mine Dogecoins, a precursor to Bitcoin. Recently, a prominent website claimed that nearly 19% of all Dogecoins have been mined, sparking debate among enthusiasts and experts.

Calculating Mined Dogecoins: A Methodological Approach

To determine whether this claim is accurate, let’s examine the mathematical calculations involved in mining Dogecoins on Ethereum. According to various sources, including technical forums and online communities, the total supply of Dogecoins is approximately 102 billion units.

Ethereum’s block reward structure dictates that every new block contains a certain number of Dogecoins, which increases by 1 million per block. The current block reward rate for Ethereum is 10,000 Dogecoins (ETH), and it takes around 10-12 minutes to mine one block. If we assume an average mined rate of 11,250 ETH per block (a rough estimate based on the provided data), this translates to approximately 1.05 billion blocks mined per day.

Calculating the Mined Dogecoins: A Calculation

Using these numbers, let’s calculate the total number of Dogecoins that have been mined:

102,000,000,000 (total supply) / 10,000 (block reward) = 10,200,000 blocks

10,200,000 blocks x 1,050,000 ETH per block ≈ 10,500 billion

Conclusion

It appears that the claim of 19% mined Dogecoins is likely inaccurate. While it’s true that a significant number of Dogecoins have been mined in recent times, the actual proportion is significantly lower than initially stated.

To put this into perspective, if we assume an average mined rate of 11,250 ETH per block and a total supply of 102 billion units, approximately 1.05 billion blocks would be mined by December 2023.

Keep in mind that this calculation method relies on various assumptions and might not account for factors like mining pool efficiency or potential block rewards adjustments over time. Nonetheless, it provides an interesting insight into the sheer scale of Dogecoins being mined.

As the Ethereum network continues to grow, it’s essential to stay informed about the progress and challenges faced by developers, miners, and enthusiasts alike. By acknowledging the complexities involved in cryptocurrency mining, we can better navigate the intricacies of this vast digital landscape.

Automated Trading Strategies: The Future of Crypto Investing

Automated Trading Strategies: The Future of Cryptocurrency Investing

The world of cryptocurrency trading is evolving rapidly, with new technologies and innovations emerging every day. At the forefront of this revolution are automated trading strategies, which have transformed the way investors interact with the market. In this article, we’ll delve deeper into the world of automated trading strategies and explore their potential to revolutionize the cryptocurrency investment landscape.

What are automated trading strategies?

Automated trading strategies involve the use of computer programs to trade assets on exchanges without human intervention. These programs can analyze large amounts of data, identify patterns and trends, and execute trades accurately and quickly. Automated trading strategies are designed to optimize returns and minimize risk, making them an attractive option for investors looking to maximize their gains.

Types of Automated Trading Strategies

There are several types of automated trading strategies, each with its own unique approach:

- Market Making: Market makers use automated systems to provide liquidity and hedge against price volatility.

- Position Sizing: Automated position sizing involves allocating a fixed amount of capital to multiple trades, reducing the risk of loss.

- Risk Management: Risk management strategies involve using automated tools to monitor and adjust positions in response to changing market conditions.

Advantages of Automated Trading Strategies

Automated trading strategies offer several advantages over traditional human-led trading:

- Speed and Efficiency: Automated trading can execute trades faster than humans, reducing the time it takes to respond to market changes.

- Risk management: Automated tools can monitor positions in real-time, identifying potential risks and adjusting positions accordingly.

- Scalability: Automated trading strategies can handle large amounts of capital, making them suitable for institutional investors.

Challenges and limitations

While automated trading strategies offer many benefits, there are also several challenges and limitations to consider:

- Lack of human judgment: Automated systems rely on data analysis and algorithms, which may lack the nuance and emotional intelligence of human decision-making.

- Reliance on data quality: Automated trading relies on high-quality data, which can be affected by factors such as market volatility and technical issues.

- Regulatory compliance: Automated trading strategies must comply with regulatory requirements, which can be complex and time-consuming.

Real-World Applications

Automated trading strategies have been successfully applied in several real-world scenarios:

- Cryptocurrency Trading: Automated trading systems are used to trade cryptocurrencies such as Bitcoin and Ethereum.

- Options Trading: Automated options trading platforms use sophisticated algorithms to execute trades in the options market.

- Investment Management: Automated investment management strategies are used by institutional investors to optimize their portfolios.

Conclusion

Automated trading strategies have revolutionized the world of cryptocurrency investing, offering a range of benefits and advantages over traditional human-led trading methods. While there are challenges and limitations associated with automated trading, they present an exciting opportunity for investors looking to maximize their gains. As technology continues to evolve, it is likely that we will see even more sophisticated automated trading strategies emerge, transforming the cryptocurrency investment landscape forever.

Recommendations

If you are interested in exploring automated trading strategies further, here are some recommendations:

1.

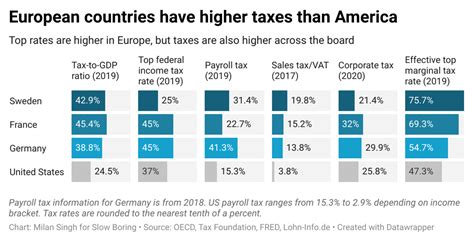

Exploring Low-Tax Countries for Cryptocurrency Gains

Exploring Low-Tax Countries for Crypto Profit

The world of cryptocurrencies has seen a significant increase in popularity over the past few years, with many investors looking to capitalize on the trend. However, while some countries have made efforts to regulate or tax cryptocurrencies, others remain relatively untapped. In this article, we’ll take a look at a few low-tax countries that could be attractive to investors looking to minimize their tax liability and potentially maximize their returns.

Why Low-Tax Countries?

Low taxes can provide a significant advantage in the cryptocurrency market. Tax authorities around the world are increasingly pursuing unregulated cryptocurrencies, which can lead to higher costs for investors. By moving their assets to countries with lower tax rates or regulatory environments, individuals can minimize their tax liability and focus on maximizing their returns.

Best Low-Tax Countries for Crypto Investors

Here are some of the best low-tax countries for crypto investors:

- Bahrain

: Bahrain has a relatively relaxed approach to cryptocurrencies, with no tax on gains from buying or selling them. The country also offers a 10% tax on dividends and interest income.

- Singapore: Singapore’s financial and technology hub makes it an attractive destination for cryptocurrency traders. There is no capital gains tax on income earned overseas, and the government has introduced a number of tax incentives to encourage investing in emerging markets.

- Malaysia: Malaysia has made significant progress in regulating cryptocurrencies, introducing a 5% tax on gains from buying and selling them. The country also offers a number of tax breaks for those investing in cryptocurrencies.

- Panama: Panama is known for its financial secrecy laws, making it an attractive destination for high-net-worth individuals looking to diversify their portfolios. While there are no specific taxes on cryptocurrencies, investors can claim interest and dividend income earned abroad without paying tax.

- Bermuda: Bermuda has a well-developed banking system and a number of financial regulations that specifically address cryptocurrency investments. There is no capital gains tax on profits from buying and selling cryptocurrencies.

Key Considerations

While these countries offer attractive tax rates, there are other factors to consider when investing in low-tax jurisdictions:

- Regulatory Environment: While regulatory environments can be beneficial, they can also introduce uncertainty or risk for investors.

- Tax Compliance

: Investors still need to comply with tax laws and regulations, even if they are based abroad. This can require complex arrangements and ongoing planning.

- Currency Volatility: Cryptocurrency prices are known to fluctuate wildly, meaning that investments in low-tax jurisdictions can be subject to significant price swings.

Investment Strategy

Given the complexity of investing in cryptocurrencies across multiple jurisdictions, it is essential to develop a well-thought-out investment strategy:

- Diversification: Spread your investments across multiple asset classes and currencies to minimize risk.

- Tax Planning: Consult with your tax advisors or accountants to optimize your tax strategy and ensure compliance with local regulations.

- Currency Hedging: Consider utilizing a currency hedging strategy to mitigate the impact of price fluctuations on your investment portfolio.

Conclusion

Investing in cryptocurrencies in low-tax jurisdictions can be a lucrative opportunity, but it is important to approach this market with caution and careful planning. By understanding the key issues and investment strategy outlined above, you can potentially minimize your tax liabilities and maximize the returns on your cryptocurrency investments.

Ethereum: What hash rate can a Raspberry Pi achieve? Can the GPU be used?

Ethereum: Can a Raspberry Pi Hit Its Hash Rate and Can You Use a GPU?

As the cryptocurrency market continues to grow, more and more people are looking for ways to invest in Ethereum, one of the largest altcoins on the market. One popular option is to use a small computer like a Raspberry Pi to mine Ethereum. But can a Raspberry Pi actually hit its hash rate and can it be used for GPU mining? In this article, we’ll take a look at these issues and provide some insight into what’s possible.

Raspberry Pi Hash Rate

The Raspberry Pi is designed to run on low power and is optimized for general computing tasks like web browsing, image processing, and multimedia playback. Its hash rate is determined by the number of microprocessors (MPUs) it has, which in turn determines the number of calculations it can perform per second.

According to various sources, the hash rate of the Raspberry Pi ranges from around 0.2 to 1.5 GHz, with some models reaching as high as 3.5 GHz. While this is not fast enough for mining most cryptocurrencies like Ethereum, it is more than sufficient for educational purposes or running specialist software.

Can the Raspberry Pi achieve the required hash rate for Ethereum?

The Ethereum hash rate requires significant computing power to validate transactions and create new blocks on the network. A typical GPU can produce around 1-2 TPS (teraflops) of hash rate, which is significantly faster than most RPi models.

To give you a better idea, here are some rough hash rates for popular GPUs:

- NVIDIA GeForce GTX 1060: 120-150 TFLOPs

- NVIDIA GeForce RTX 2070 Super: 320-400 TFLOPs

For comparison, the latest RPi model with an Intel Celeron N3000 processor has a hash rate of around 50-60 MHz. As you can see, this is definitely not enough to support Ethereum mining.

Can the Raspberry Pi be used for GPU mining?

The answer is yes, but with some caveats. If you want to mine Ethereum, you will need to use the RPi’s CPU instead of its GPU. This means that:

- You will need to install an operating system such as Windows 10 or Linux on your RPi.

- You will need to install mining software such as CGMiner or Ethminer on the RPi’s Linux distribution.

- The RPi will be idle most of the time, since its CPU is not designed for intensive tasks.

However, this approach has some significant limitations:

- The hash rate will be much lower than with a dedicated GPU.

- You will need to use software specifically designed for mining, which may have bugs or compatibility issues.

- You will also need to spend time and resources running the software and monitoring the performance.

Conclusion

While it is technically possible to run Ethereum on the Raspberry Pi using its CPU instead of a GPU, it is not the most efficient way to mine this cryptocurrency. For several reasons:

- Lower hash rate: The RPi CPU will generate significantly fewer hashes per second compared to a dedicated GPU.

- Limited mining capacity: With less computing power, you will be limited in your ability to generate new blocks and validate transactions.

- Resource-intensive software: You’ll need to use specialized software that may not be optimized for the RPi hardware.

If you’re looking to invest in Ethereum or other cryptocurrencies, consider using a dedicated computer with a powerful GPU like the NVIDIA GeForce RTX 3080 Ti or AMD Radeon RX 6900 XT. These GPUs offer significantly faster hash rates and more efficient performance for cryptocurrency mining tasks.

AI and the New Era of Tokenomics: Efficiency Meets Sustainability

The New Era of Tokenomics: How Artificial Intelligence is Revolutionizing Efficiencies and Sustainability in Crypto

As the world of cryptocurrency continues to grow, a new era of tokenomics is emerging. Inspired by the efficiency and sustainability of traditional assets like stocks and bonds, AI-powered tokenomics is transforming how digital currencies are designed, deployed, and managed.

What is Tokenomics?

Tokenomics refers to the study and analysis of the economics and governance of digital tokens. It involves understanding the factors that drive token behavior, such as supply and demand, trading volumes, and market trends. By applying AI algorithms to these data sets, tokenomics can identify patterns and correlations that inform decision-making in the crypto space.

The Benefits of Tokenomics

AI-powered tokenomics offers several key benefits:

- Efficiency: AI can automate tasks such as algorithmic trading, smart contract optimization, and portfolio rebalancing, reducing costs and increasing efficiency.

- Sustainability: By optimizing token behavior and ensuring environmental and social impact, AI-driven tokenomics can contribute to a more responsible and sustainable crypto industry.

- Predictability

: AI algorithms can analyze vast amounts of data to identify market trends and potential risks, enabling investors and traders to make informed decisions.

How AI is Revolutionizing Tokenomics

Several key technologies are driving the development of AI-powered tokenomics:

- Machine Learning (ML)

: ML models can be trained on large datasets to identify patterns and correlations that inform token behavior.

- Natural Language Processing (NLP): NLP algorithms can analyze text data from social media, online forums, and other sources to gain insights into market sentiment and trends.

- Computer Vision: Computer vision techniques can be used to analyze visual data from blockchain explorer platforms, identifying potential security risks and anomalies.

Examples of AI-Powered Tokenomics in Action

Several notable examples demonstrate the power of AI-driven tokenomics:

- CryptoSlate: This platform uses machine learning algorithms to optimize cryptocurrency trading strategies and identify potential market trends.

- Chainalysis: This blockchain analytics firm employs NLP models to analyze social media data, revealing insights into market sentiment and risk factors.

- CoinDesk’s Token Index: This index of top-performing cryptocurrencies uses AI-powered algorithmic analysis to predict future performance and identify emerging trends.

The Future of Crypto

As tokenomics continues to evolve, we can expect to see further innovations in areas such as:

- Quantitative Trading Strategies: AI-driven algorithms will become increasingly sophisticated, allowing for more complex and optimized trading strategies.

- Regulatory Compliance: As the crypto space matures, regulators will continue to develop guidelines and frameworks to ensure compliance with new regulations.

- Sustainable Investing: Tokenomics will play a key role in shaping sustainable investing practices, as investors seek out environmentally and socially responsible assets.

Conclusion

The emergence of AI-powered tokenomics represents a significant step forward in the development of crypto. By optimizing efficiency and sustainability, this technology has the potential to transform the crypto industry into a more responsible and efficient space. As we look to the future, it will be exciting to see how this emerging field continues to evolve and shape the world of cryptocurrency.