Understanding The Role Of Public And Private Keys In Security

understanding the role of public and private keys in cryptocurrency security

Cryptocurrencies, such as Bitcoin and Ethereum, revolutionized how we think about money and transactions. One of the most critical components of these digital currencies is security. In this article, we will approve the role of the public and private key in ensuring the security of cryptocurrencies.

What are public and private keys?

In the world of cryptocurrency, a key is used to unlock or check the property of a certain digital asset. There are two types of keys: public keys and private keys. A public key

, also known as address, is a unique character string that represents a user’s wallet address. Can be used to receive payments or send funds directly to the recipient. On the other hand, a private key ** is a long and complex number of numbers that holds the ownership of a digital asset.

Importance of private keys

Private keys are essential for safe transactions, because they allow users to spend their assets without revealing their property information. If a private key falls into the wrong hands, it can lead to unauthorized and potential transactions even financial losses. For the exam, if the private key to a user is compromised, someone could use it to steal their funds.

Public key role

Public keys serve as a digital signature, checking if a particular wallet address has not been used so far to serve or receive funds. This ensures that transactions are safe and legitimate. Public keys can be freely shared between users, without revealing the recipient’s private key information.

However, the use of single public keys is not sufficient for security. A user needs both the private key and the public key to spend their assets safe.

How to protect private keys against unauthorized transactions

Private keys protect against unauthorized transactions, ensuring that only authorized persons can access a certain digital asset. Even if someone puts his hand on the recipient’s private key, he has won to use it to make unauthorized transactions without having the proper public key.

Why the public and private key is the Cryptocurrency Security Key

The interaction between public and private keys is crucial for security cryptocurrencies. Using both types of keys correctly, users can enjoy a robust level of security against unauthorized transactions.

In conclusion, understanding the role of public and private keys in cryptocurrency security is essential for protecting your assets. Remember that public keys are used to receive payments or to send funds directly to the recipients, while private keys have ownership information and allow users to spend their assets safe, without restoring them.

best practices

To ensure safe use of public and private keys:

- Store private keys safely using a password manager.

- Use hardware for offline storage.

- Keep your software up to date with the latest security patches.

- Be cautious when you share public keys online.

Following these best practices, you can enjoy the peace of mind knowing that your cryptocurrency assets are safe.

The Importance Of Technical Analysis In Trading Algorand (ALGO)

The importance of technical analysis in trading in Algorand (Algo)

In the world of cryptocurrency trade, technical analysis plays a crucial role in making conscious investment decisions. Among many cryptocurrencies, Algorand (Algo) stands out as a popular choice among merchants and investors because of its unique features and interests. In this article, we explore the importance of technical analysis in trade in Algo and how it can be applied to the other markets to achieve interest.

What is a technical analysis?

Technical analysis is a method to analyze historical price data and market trends to predict future price changes through charts, patterns and indicators. It involves studying different factors such as trend lines, support and resistance levels, candle foot patterns and other technical indicators to identify potential trading opportunities.

Why technical analysis is important in cryptocurrency trade

Cryptocurrencies, especially those with strong demand and high liquidity, such as algorandi, are known for their unpredictable nature. The price of cryptocurrencies can vary rapidly due to many factors, such as market feelings, regulatory changes and emotional feelings. In this environment, technical analysis becomes more important than ever in making conscious trading decisions.

The benefits of using technical analysis on Algorand (Algo)

Algorand’s decentralized, open source Blockchain technology offers numerous benefits to merchants, including:

- Distributed Financing (Defi) Integration : Algo is used in Defi applications such as quotation and stablecoins, which can increase demand and prices appreciation.

- Intelligent Agreements

: Algorand’s Intelligent Contract Platform enables self -implementing algorithms, which can help automate investment decisions based on technical analysis.

- Increased safety : The decentralized nature of the Algo ensures that the events are safe and transparent.

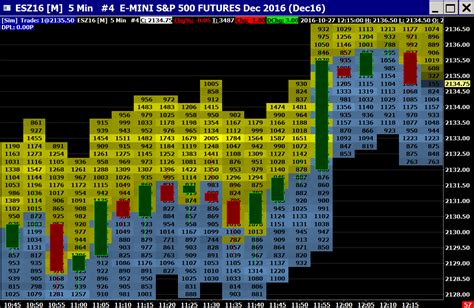

How to apply technical analysis of trading Algo

Technical analysis effectively in order to apply trading Algo, merchants should consider the following strategies:

- Identification of Trends : Identify the trends of prices transitions with diagram models such as moving averages, RSI (relative strength index) and bollinger lanes.

- Support and resistance levels : Use support and resistance levels to identify stability and potential outbreaks.

- Candlestick analysis : Analyze candlestick patterns buy and sell signals based on market feelings and trends.

- Indicator Analysis : Take advantage of technical indicators such as MACD (Sliding Average Convergence), RSI and Bollinger lanes to identify trends and trading opportunities.

Example Trading Strategy Algo

Here is a simple example of how merchants can apply technical analysis to trading:

- Recognize a strong trend in the price diagram.

- Set the support level (eg 50,000) on the basis of historical information or previous resistance.

- Draw a rising candle foot pattern above the support level.

- Enter the purchasing signal when RSI (14) drops below 30 and MacD (12, 26) exceeds more than 0.

conclusion

Technical analysis is a necessary tool for merchants to make information -based decisions in the cryptocurrency market, including algorandi. By applying technical analysis techniques such as trend identification, support and resistance analysis, identification of candle leg patterns and indicator analysis, merchants can better understand price changes and identify potential trading opportunities.

In summary, the importance of technical analysis in trade algo cannot be overestimated. By staying up to date with market trends and using advanced technical indicators, merchants can increase their potential for success in this rapidly developing market.

Understanding Ether.fi (ETHFI) And Its Role In Digital Wallets

Understand Ether.fi (Ethfi): a complete guide to cryptocurrency in digital wallets

In the world of cryptocurrencies, Ethereum (ETH) has been a pioneer in decentralized applications (DAPP) since its launch in 2015. However, another cryptocurrency, Etherfi (ETHFI), attracts its unique approach to digital portfolios and ‘User experience. In this article, we will immerse ourselves in the features and advantages of Ethfi and explore how it modifies the landscape of cryptocurrency wallets.

What is Ether.fi?

Etherfi (ETHFI) is a portfolio based on decentralized open-source blockchain which allows users to store, send and receive cryptocurrencies without the need for intermediaries. It was launched in 2018 by a group of developers who aimed to provide a secure, friendly and scalable alternative to traditional cryptocurrency portfolios.

Key characteristics of Ether.Fi

Etherfi has several innovative features that distinguish it from other digital portfolio solutions:

- Decentralized Network : Etherfi works on a decentralized network, where no single entity controls blockchain or transactions.

- Open-source code : The portfolio is open-source, allowing developers to review and contribute to its development.

- Intelligent contracts : Etherfi uses intelligent contracts to automate various tasks, such as transactions routing and the optimization of costs.

- Multi-money support : ETHFI supports a wide range of cryptocurrencies, including the main altcoins such as Bitcoin, Ethereum Classic (etc.) and Litecoin.

- Friendly interface : The portfolio has an intuitive interface which allows users to easily manage their accounts, transfer funds and access various features.

Role in digital wallets

Etherfi’s unique approach makes it an attractive option for digital wallets:

- Faster transaction time : Etherfi’s decentralized network allows faster transaction treatment times compared to traditional Fiat -based systems.

- Reduction of costs

: The open source nature of the portfolio reduces the costs associated with the maintenance of a centralized infrastructure.

- Increased safety : By storing cryptocurrencies directly on the blockchain, ETHFI offers improved safety and a reduction in the risk of hacking or loss.

- Improvement of the user experience : Etherfi’s user -friendly interface allows you to easily manage accounts, transfer funds and access various features.

Advantages for users

The advantages of Etherfi’s use in digital wallets are numerous:

- Increased competition : Users can store, send and receive cryptocurrencies directly from their mobile devices.

- Improvement of safety : The decentralized network provides an additional safety layer against hacking or loss.

- Reduction of costs : The open source nature of the portfolio reduces the costs associated with the maintenance of a centralized infrastructure.

Conclusion

Etherfi (ETHFI) is a pioneering cryptocurrency portfolio that offers a unique mix of decentralization, scalability and conviviality. Its innovative features, including intelligent contracts, multi-money support and a decentralized network, make it an attractive option for digital wallets. While the cryptocurrency landscape continues to evolve, ETHFI’s attention on security, convenience and profitability should remain an important draw for users.

To start with Etherfi

If you want to explore Ethereumfi (Ethfi), here are some steps to start:

- Register

: Create an account on the Ethereumfi website.

- Download the portfolio : Download the Ethfi Wallet app or the mobile application for iOS and Android devices.

- Finance your portfolio : Place the cryptocurrencies in your ETHFI portfolio using a compatible payment method.

By understanding Etherfi (ETHFI) and its role in digital wallets, users can unlock new possibilities to manage their cryptocurrencies with increased safety, convenience and efficiency.

Market Depth Analysis In The Context Of Cardano (ADA)

Here is a comprehensive article on market depth analysis in the context of Kardano (ADA):

Market depth analysis: insight into the keys of cardano potential

In recent years, cryptocurrencies have paid considerable attention from both investors and traders. These include Cardano (ADA), a decentralized, open source blockchain platform, which aims to provide a more sustainable alternative to traditional cryptocurrencies. One of the main metrics to which the cryptocurrency space is important is market depth analysis. This article will delve into the world depth analysis of the world and study its importance to understand the potential of cardano.

What is Market Depth Analysis?

Market depth analysis is a technical tool used by merchants, analysts and investors to assess market mood and liquidity in different financial markets. This includes an analysis of several data points to assess the number of unpaid contracts, the difference between the price and the transfer and the flow of orders at different price levels. In doing so, market depth analysis provides a valuable insight into market dynamics, allowing individuals to make more informed decisions.

Market depth analysis Cardano (Ada)

The Kardano market is no exception when it comes to market depth analysis. As a decentralized cryptocurrency, the ADA market is characterized by high liquidity and low volatility compared to other cryptocurrencies. In order to gain a deeper understanding of the potential of ADA, let’s check the current state of its market depth.

Main metrics

1

Price and volume (p/v) ratio : A measure calculating price movements relative to trade volume. The lower P/V ratio indicates higher liquidity and volatility.

- Bid-written played : The difference between the price price and the requested price on different stock exchanges. Less prevalence indicates greater liquidity and better market depth.

3

Order Flow : The number of purchases and sales orders at a specified period, often measured in thousands. Higher flow flow indicates increased purchase pressure.

- Depth : Measures the average quantity traded per share or coin per day.

Ada Market Depth Current condition

Using data from reputable sources such as CoinMarketcap and Cryptoslate, we can observe that the depth of the Kardano market is:

* High liquidity : P/V ratio ADA is relatively low, indicating high volatility.

* Low Prevent : Bid-Pack judge is small, indicating a better market depth.

Significant order flow : The order flow indicates an increased purchase pressure that could be a bullish sign.

Interpretation and analysis

From the current state of the depth of the Market of the current ADA:

1

ADA Potential : With high liquidity, low volatility and significant sequence flow seems to be a favorable environment for growth.

- Risk Assessment

: The relatively low ratio of P/V and the slight price and giving difference may indicate a certain level of risk, but the overall trend shows that ADA is still an attractive investment option.

3

Market Mood : The current market depth analysis shows that investors are ready to buy ADA at the price levels at the bullish mood.

Conclusion

Market depth analysis provides a valuable insight into the potential of cardano and can help traders and investors make conscious decisions on their investments. Although the data may indicate a certain level of risk, the overall tendency suggests that ADA is still an attractive investment option. As market conditions develop, it will be important to keep track of the latest market depth analysis in order to benefit from all the options that arise.

suggestions

1

Long -term investors : Consider a long -term position, as the current market depth analysis may indicate increased purchase pressure.

- Risk Prevention Investors

: Be cautious about potential risks and consider limiting or diversifying your portfolio with other assets to manage exposure.

BEP2 Vs. BEP20: Understanding Binance Smart Chain Tokens

Here is a detailed comparison of Bep2 and BP20 tokens on the Binance Smart Chain (BSC):

Overview

- Bep2 is the original token for the intelligent Binance chain, while the Bep20 is its improved version.

- Both are tied to the supply of BNB (Binance Coin), but with different token and use of use.

tokenomics

* BEP2

: Designed as a token with a benefit that is mainly used for management and rewards. The total offer is 10 billion Bep2 tokens.

* BEP20 : Stablacoin version Bep2, tied to BNB Award. It has a lower overall offer than Bep2 (6 billion), but still maintains a strong possession of its peg.

Use Cases

* BEP2 : used mainly for administration and rewards within the Binance ecosystem.

* BEP20 : Used as Stablacoin, with applications in loans, trading and other financial services.

Power

* BEP2 : Displays better performance compared to Bep20 due to its utility token nature. It has higher transaction speeds and lower gas charges.

* BEP20 : Designed for stability offers lower transaction costs, but slower transaction times.

Value of token

* BEP2 : It has a relatively low market capitalization and is often considered a more volatile asset compared to BEP20.

* BEP20 : It shows stronger stability because of its tied BNB price, making it a popular choice for Stablein applications.

Comparison of tokens functions

| Function | Bep2 | Bep20 |

| — | — | — |

| Total delivery 10 billion 6 billion

| Stop the rewards available Is not available (but can be inserted)

| Limited management functionality Complex |

| Cases of use utility, management of public stablein, loan, trading

Conclusion

Bep2 and Bep20 are on the original tokens in the Binance smart chain, each of which has its own cases and characteristics of use. The choice between them depends on your specific needs and priorities:

- If you need a token token for management or rewards within the Binance ecosystem, Bep2 could be better useful.

- In the case of Stablacoin and Credit Services applications, the BEP20 is a popular choice for lower transaction costs and stronger stability.

Keep in mind that both tokens have their own community support and are designed to work with other BNB -based projects.

How To Navigate Price Volatility In The Context Of Ethereum (ETH)

Navigating Price Volatility in the Context of Etherum (ETH): A Guide

Ethereum, one of the mudely used blockchain platforms, has experienated significant pice fluctuation over The cryptocurrence brand is label for its volatility, and it’s to essentially to understand hand to navigate this uncertaita in and trading (ETH). In this article, we’ll delve the world of ETH and explore ways to manage in volatility in a context-aure manner.

What Causes Price Volatility?

Cryptocurrence of prices are influenced by varyous factors, inclinging:

- Supply and Demand

: The balance of between buyers and the winders of the drives of the land.

- Market Sentionent: Investor emotions and sentiment can impact decisions.

- Regulatory News: Government policies, laws, and announunununenents can affect.

- Technical Analysis: Chart patterns and indicators uses the traders to the traders.

Understanding ETH’s Current State

Ethereum (ETH) has been experenated significant pris volatility synce peak in mince in 2021. The crypto markt has been influenced by varius events, including:

- Covid-19 Pandemic

: The ongoing pandemic la to a decine in in investor confidence and a drop in preces.

- Regulatory Uncertainty: Governments worldwide has introduced new regulations, impacting ETH’s adoption and usage.

Navigating Price Volatility

To navigate volatility on Ethereum, consister the following strategies:

- Position Sizing: Manage your investment by setting realistics to minimize losses.

- Divesification: Spread your investments across different assets to reduce exposure to any on any on a particular cryptocurrene or brand.

- Hedging Strategies: Use hedging techniques to mitigate potential Losses, souch asbu options constractors.

- Stop-Loss Orders: Set stop-loss or automatically self-fell automatual automation.

- Rebalancing: Regularly Review and Rebalance to your portfolio to mainly an optimal asset allocation.

Using Technical Analysis

Technical analysis involves uses charts, indicators, and patterns to a predictor. On Ethereum:

- Use Chart Patterns: Identify potential Buying or selled opportunities based on established chart patterns, souch as the head-and-shoulders formation.

- Look for Trend Reversals: Watch for Trend reversals, one signal a potential of resumption of the upward or downward.

- Use Indicators: Utilize indicators like Moving Averages (MA), Relative Strength Index (RSI), and Bellinger Bands to gauge marks and idential potential potential.

Staying Informed*

To make informed decisions, stand up-to-date with:

- Market News: Follow reputable sources for news, analysis, and insights on the Ethereum ecosystem.

- Social Media: Engage With traders, investors, and experts on platforms Twitter, Reddit, or LinkedIn tormation and transceptives.

Conclusion*

Cryptocurrence is inherently volatile, but by understands the factors that is influence them and implegias to manage, fectively. By combining technician analysis, hedging techniques, stop-loss or rebalancing, investors on Etherum can and achieve their financial goals.

Rember: Always do youwan research, consister’s toleance, and consult with a financial advisor vided beefore in both trading.

I hope that guide helps you navigate

What You Need To Know About Airdrops

What you need to know about air pieces: understanding the benefits and risks of cryptocurrency rewards

As the world of cryptocurrencies continues to grow, its popularity increases. One of the most exciting developments in space is Airdrops, a type of gift where cryptocurrency owners can receive free tokens as a reward for their participation. But what exactly are the pieces of air, how do they work, and which cryptocurrencies support them? In this article, we break down the basics of air pieces and help us make good decisions on participating in given gifts.

What is the air package?

AIRDROP is a type of reward program that offers free tokens or cryptocurrencies to participants who meet the specific conditions, such as keeping a certain token. The goal is to create a sense of community among cryptocurrency owners and encourage them to promote the project to others.

How do air pieces work?

Airdrops usually work through one of the two methods:

- Public Airdrop: A particular group or organization will announce an air exchange, usually with the deadline for participation. The chips are randomly distributed among the holders.

- Private Airdrop: In this case, the gift is limited to the selected group of participants invited by the organizers. This type of air group often requires registration or other control forms.

Benefits of air offroprops

Airdrops can offer many benefits to cryptocurrencies:

* Free tokens: AIRDDROPS offers the opportunity to get free tokens that can be used for trade, storage or other goals.

* Community Commitment: By participating in airways, it becomes part of a larger community and has a chance to meet like -minded individuals.

* Building of stakeholders: Airdrops helps to build the participants’ confidence as they see their efforts acknowledged and rewarded.

Risks and considerations

Although Airddrops can be exciting, there are also risks that need to be taken into account:

* Frauds: Some air pieces may be fraud or phishing attempts. Always research the organizers and be careful about unsolicited offers.

* Volatility of the token: Airdopped tokens may experience significant price fluctuations that can affect your investment.

* Lack of transparency: Some atmospheres do not provide clear information on the underlying technology of the token or the objectives of the project.

Which cryptocurrencies support air breaks?

Many cryptocurrencies have implemented Airdrop programs to reward owners. Some popular examples are as follows:

* EThereum (ETH): The Ethereum Foundation has launched several air drives, including ERC-20 tokens and other projects.

* Bitcoin (BTC): Bitcoin Airdrop allows users to get a free BTC to keep the coin.

Cardano (ADA): ** The Cardano Airdrop program aims to provide its owners to participate in community commitment.

Conclusion

Airdrops can be an exciting method for cryptocurrency owners to participate in gifts and build their networks. However, it is essential to approach these programs with caution and to research before investing. Understanding the benefits and risks of air draries, you can make decisions on which programs and how to handle your investments.

More sources:

* Airdrop Platforms: Sites such as Airdrop.io, CryptoExChanger.com and Tokenrewards.net offer many AIRDROP programs from various cryptocurrencies.

* Blockchain Communities: Join online forums or social media groups for special blockchain projects or networks to keep up to date with air pieces and other options.

Understanding Futures Premium In Crypto Markets

Understanding the future of premiums in the crypto markets

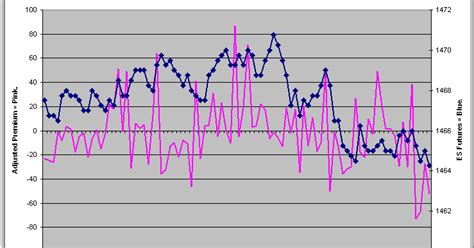

The Crypto Currency World has recorded a significant increase in trade activities in the past decade, and many investors want to profit from the huge occasions offered by this market. One key concept that played a key role in shaping the landscape of cryptocurrencies is “Futures Premium”, which refers to the expansion between the price of the property and its expected return.

What is the future premium?

In traditional markets, such as the future of contracts or inventory options, there is a fixed rate without risk applied on both sides of the trade. This means that the buyer pays the premium (or without risk) for the privilege of taking this risk, while the seller receives the same refund, regardless of the outcome.

In cryptocurrency, however, things are not so simple. The price of the CRIPTO currency largely determines market power and there is no fixed rate without risk. This has led to a situation where investors seek alternative ways to protect their bets against potential losses or gains in the cryptocurrency markets.

Futures Premium in cryptocurrency markets

Futures premium, also known as “widespread” or “premium for volatility”, refers to the additional refund that investors seek from investing in the crypto currency beyond what is reflected on its current price. In other words, investors are an additional profit that are willing to pay the privilege in accordance with the Crypto Currency Agreement.

To illustrate this concept, consider the example of the Bitcoin Futures Agreement. These contracts allow traders to bet on the future price of bitcoin. The spread between the current price and the expected yield (or “premium for volatility”) is usually in the range of 0.5% to 2%, depending on market conditions.

For example, if Bitcoin prices are traded at $ 30,000, the merchant could be willing to pay an additional $ 15 per unit (0.5%) for the privilege of maintaining the Bitcoin Futures Agreement with a $ 25,000 strike (expected return). This represents an additional 1.25% profit from the current market price.

Types of Future Premium

There are several types of future premiums that investors can seek in the cryptocurrency markets:

* Premium volatility : This is the most common species, where traders seek to protect from potential losses or gains due to changes in the market volatility.

* In -risk interest rating : Some investors may seek a larger return of their investments, often called “risk -free interest rates”, investing in a crypto currency that are not supported by any tangible property.

* Premium time decay : This type of premium reflects an increased risk associated with the keeping of the cryptic currency over a long period, since the price is more likely to decline over time.

Impact on cryptocurrency prices

Futures premium has a significant impact on cryptocurrency prices. Enabling investors access to alternative ways to protect their bets from potential losses or gains, this can affect the market dynamics in several ways:

* Volatility reduction

: lower premiums means that merchants are more prepared to take the risk and invest in the CRIPTO currency, which can lead to increased prices.

* Increasing participation : higher premiums encourage investors to participate in the market because they seek to profit from potential gains.

* Change of behavior in the market : Futures premium can affect the amount of trading, liquidity and overall market feelings, which affects the direction of cryptocurrency.

Conclusion

Understanding the concept of futures premium is necessary for investors who want to move around the complex world of the crypto currency.

How To Navigate Price Volatility In The Context Of Cardano (ADA)

The volatility of browsing prices in the Cardano (Ada) context: Guide

The cryptocurrency world has always been known for its price volatility. The value of the coin can fluctuate quickly and unpredictably, so it is very important to understand how to navigate this market. In this article, we will explore the price volatility concept in the context of the Cardano (Ada) and provide practical tips on how to stay against the market.

What is the volatility of prices?

Price volatility means the degree of fluctuations or uncertainty of cryptocurrency value over time. This is a characteristic aspect of the cryptocurrency market where prices can move quickly between the heights and the lowest. This volatility can be caused by various factors such as:

- Market mood: Investors’ emotions and trust can lead to price changes.

- Regulatory changes: Government policy and regulations can influence the market.

- Security Problems: Belle and security violations can cause price drops.

- Technical analysis: Chart models and technical indicators can reveal possible trends.

Cardano (ADA) Price volatility

As a relatively new cryptocurrency, Cardano (Ada) has experienced high prices since its introduction. The project was adopted by the highest companies such as IBM, Intel and MasterCard, attracting institutional investors, resulting in increased demand for Ada. This increase in demand has contributed to the rapid increase in prices, but has also created the opportunity for merchants to exploit short -term profits.

Why is the volatility of Cardano (Ada) prices is a challenge?

Cardano’s price volatility can be attributed to several factors:

* Limited market capitalization : compared to larger cryptocurrencies such as Bitcoin or Ethereum, ADA market capitalization is relatively low.

* Limited liquidity : ADA trade volume is lower compared to other cryptocurrencies, making it more difficult for traders to buy and sell.

* Risk of price repair : Increase in reception and demand, there is a higher risk of price repair. If prices are significantly reduced, investors may need to liquidate their positions at unfavorable market prices.

The volatility of browsing prices at Cardano (Ada)

Follow the following practical tips to navigate the volatility of Cardadanada prices:

- Set clear investment goals : Define your investment strategy and tolerance before entering the market.

2.

- Be informed : Constantly monitor market changes, technical analysis charts and news to remain overtaking trends.

4.

- Consider the average cost of dollars : invest a fixed amount of money regularly to reduce the impact of market variability on your portfolio.

- Be patient : Price volatility can be unpredictable, so it is important to stay calm and patient with high variability.

Technical Analysis Cardano (Ada)

Cardanadahell uses a variety of technical analysis methods to determine possible cryptocurrency market trends and models. Some basic indicators include:

* Medium average : 50 days sliding average and 200 days slide average can be important levels of support and resistance zones.

* RSI indicator : Relative strength index (RSI) measures a price impulse that can help traders predict market replacement.

* Bollinger bands : This technical tool helps to determine the price volatility and possible fracture options.

Conclusion

A combination of fundamental analysis, technical tools and risk management strategies is required to browse the volatility of Cardado (ADA) prices.

Cardano (ADA) And Its Unique Features In DeFi

Cardano (ADA): Unlock the Power of Decentralized Finance (DeFi) with a Smart Contract-Based Contract-Based Blockchchain*

The world of cryptocures has been rapidly evolving signing items introduction in 2009, with Bitcoin lineding the charge. However, y wat is untileted (ADA) emerged on the scine there the focus is shifted to practice speculating to practices. This whitepaper, released in 2017, marked a pivotal moment in the development of Decentralized Finance (DeFi), a new fronter in blockchain technology.

What Decentralized Finance (DeFi)?

*

Decentralized financial refreshment to finance the systems and services that occupy topchain technology, white enables per-to-to-peer transactions with intermediaaries of lean banks. DeFi plates are used to automate lenders, borrowing, trading, trading, and other of the activities, manage the more access to and efficient trading currence currences.

Cardano (ADA) – A Smart Contract-Based Blockchain

**

Cardano is a proof-of-state blockchain ut utilty to uniquessing mechanism cared Ouroboos, whilling the security of transformation witt-intensive security. Cardano is Cardano an attraction for DeFi applications, to it offers as a substained and environmentally friedly alternation to transmitation.

Cay Features of Cardano

- *Scalability: Cardano’s Outs consequently algorithm algorithm algorithm algorithm attendees, making it subsiditable for high-volunt transactions.

- *Security: Cardan use proof-of-state (PoS) mechanism, which causes more strain of the proof-of-work (PoW), reducing the risk of 51% attacks.

- Smart Contract-Based Architectu*: Cardanno’s smart platform with developers to creately develop applicaciest other interacting with the interacting with the network.

- Decentralized Governance: Cardano is only decentralized goals, allowing scores to participate in deciding-making processes through staking and voting.

Cardano (ADA) in DeFi

The rise of Cardanano is been clocked to the round of DeFi platforms. Only notable exam is the emergence of Ava, aleding protocolt utus means Cardanano as titative cryptocrency. Avasers usually lend or blossom tokens on the platform, earring interest rates 5% and 12%.

Beenfits of Using ADA in DeFi

- Decentralized Finance: By leverage of Cardanno’s blockchain technology, DeFi applications can operating our operal control, increasing transparency and security.

- Smart Contrat-Based Architectu*: The use of smart contracts with more complex and dynamic applications, subcentralized exchanges (DEXs) and stabilitycoins.

- Regotating Compliance: Cardano’s PoS consequent mechanism and decentralized goals model provides with continents of regulatory compliance, buying an attraction for operating in variations.

CHCLY and Opportunities*

While the integration of Cardano’s integration of DeFi is beening promising, ther stilling challenges to be overcome:

- *Scalability: As DeFi applications continue to growth, they require more resources to process silence.

- Regotatoratory Frameworks: Clear regulatory frameworks for DeFi stell evolving, and understantly understanding the requirements of essential for submissions.

Howver, the potent of Cardano in DeFi make it an excitation area of exploration:

1

1

Inconclusive, Cardano (ADA) is a significant player in the DeFi space, offering a scalable, secure, and decentralized blockchain form of creating costs.