Exploring The Future Of NEAR Protocol (NEAR) In Decentralized Exchanges

Here is an article on the future exploration of the nearby protocol (close) in decentralized stock exchanges:

Name:

Growth of close protocols: Pioneer of decentralized exchange in cryptocurrency space

Introduction:

The nearest Technologies, Inc. (close) for years have created waves in the cryptocurrency area. Israeli businessman and engineer Shuna Avni founded a decentralized, open source operating system near the protocol to allow quick, secure and cheap transactions using various networks. In this article, we are immersed in the future of the nearby protocol in decentralized stock exchanges (Dexs) and discovered why it is designed for significant growth.

Decentralized Exchanges: Ideal storm for nearby protocol

Dexs has become increasingly popular with cryptocurrency fans due to their elasticity, security and low prizes. Since traders now have a wide range of Dex platforms, such as Uniswap, Sushiswap and Curve, now have access to a huge range of trade couples without worrying about intermediaries or centralized stock exchanges (CEXS). Near the decentralized architecture of the Protocol, it offers an attractive opportunity for users who appreciate decentralization and want to control their transactions.

Near the Protocol decentralized exchange ecosystem (DEX)

The Dex Ecosystem nearby is designed at the top of a nearby blockchain, allowing users to rent trade, rent and cryptocurrency on the platform. DEX uses a unique consensus mechanism called Capacity Certification (POC), which ensures that only the most appropriate validators can participate in the network. This approach not only reduces transaction costs but also increases network security.

Benefits of the Protocol nearby in decentralized stock exchanges:

1

Low fees: The Dex Ecosystem nearby offers significantly lower fees than traditional CEX, providing an attractive opportunity for merchants who want to reduce their financial burden.

- Security: With decentralized architecture and POC’s consensus mechanism for the protocol ecosystem close to the Dex Ecosystem is based on security and relief, ensuring that user tools remain safe from HACKS and other malicious activities.

3

User friendly interface: The Dex platform nearby Protocol offers a user -friendly interface that allows traders to easily browse trade couples, create new orders and reduce trade.

- Integration with other blockchain networks: This allows you to integrate seamlessly near the protocol decentralized architecture with other blockchain networks, such as Ethereum and Solana, providing an attractive opportunity for merchants who want to trade on multiple platforms.

Future growth prospects:

As the cryptocurrency market develops even more, we can expect a significant increase in the nearby protocol in decentralized stock exchanges. Here are some potential growth opportunities in the future:

- Increased adoption: If multiple users use DEXS and use demand for almost coins near the Protocol Dex ecosystem, increasing their value.

- Expanding to new use: With technology development, we can expect new use of new use in decentralized stock exchanges, such as a loan between chains and production.

3

Partnership and Collaboration:

Protocol decentralized architecture offers an attractive option close to low fees with other blockchain networks and Dex platforms.

Conclusion:

The future of the nearby protocol gives significant promises in decentralized stock exchanges. With its unique consensus mechanism, a user -friendly interface and other blockchain networks, it is ready to become the main character in the cryptocurrency space.

How To Assess Risk Management Techniques In Crypto

Methods Direction by Riski in cryptocurrency: hand -making

Cryptocurrencies, such as Bitcoin and Ethereum, for the most investors and the name Alikes. However, as any other infestations, come to the unhemisphere of your rice to manage the opcun. In this state, we disperse, how to reign with risa in cryptocurrency and hand -ledance on the proverbial, non -publicing efficiency strategies by the pigs.

Ni Riskovna Government

Directing pins, otenko and sneezing of potential market. Ikriptovarno, management of the risa, connected with the ponimania, which can be powdered on the portfel, to the giants, the normative changes, the cessation of the non -adaptedness, the aendovogo.

Tipes Risk Cryptocurrency

Cryptocurrencies are extended with its high volatility, which is the male priorites can be fast and non -pressed. Some Tip Tip Typemon Off Crypto Currency Risk Includes in Sebe:

- Renal Voletity : Cryptocurrency rings may be very volitil, prizza is rapidly reaguated for newstations, rod and marque mood.

- Normative Figure : Ruggery and Regulatory Bodies Make Novye Laws or Summets on Cryptocurrency, Potential Currency and Adoption.

3.

4.

Task Methods Directions Risa

Declared by risa in cryptocurrency, it is important to relying the spreading, using the investigations, in Tom Chissl:

- Diversification : Investing in Writing in different classes of activa, such as action, obligation and cryptocurrency, can help to restore experimentation on the inflated for the universe.

- Distributions in Oblast : Summies from the Deneg, Invested from the Social Portfeel or in the Common Portfel, can help you sniff.

3.

4.

5.

Effective Effective Methods Control Risom

To do the efficiency management in the techniques, it has a value for:

- Set up the cellas and expertise

: Declement of Investments in the Celley, FRIS and Acting for Encurvi in Enlightenment – this is the same.

- Realize the market

: Be aware of the market centros, newly, which can be powdered into the prices of cryptocurrency.

3.

4.

- Regularly Slice and Correctine : Regularly Slice the Strategical and Regular Anti -Direction Theme in Quacity Marketing Contract.

conclusion

Methods of the management of the rishes of the tsenka in the cryptocurrency are covered for investors that the freshest to the miniaum for the potential Poteri will maximize the profitability. Grace PRISK PRICE, REALIZATION OF CHILDREN DEFFERENCE RISKE Effectiveness and Outskaya Informed Tendencies Markets, Investors Mogut Information and Drink Effective and Information. Remeber, investing is always in the frame, but the assignment of the names, you can change your exposition and maximize your own.

The Future Of Decentralised Finance: Insights From Ethereum Classic (ETC) And NFTs

Decentralized Financial Future: Ethereum Classic (TC) and Nin-Fungilable Chips Future) and Nin-Fungible Tokens)

The ancestral world is undergoing a significant transformation that moves towards the growth of decentralized technologies. Crypts such as Bitcoins, Ethereum and others related to disruption of financial systems, creating new opportunities, creating new investments in investment, tape and trade. In the Thist art we will study two two Two Express decentralized fiscal: Ethereum Classic Classic (TC) and non-shame tokens (NFT).

Sereem Classic (TC)

Ethereum Classic is a national proof (POS) cryptocurrency in the Ethereum blockchain, which forks. As long as it is Beheround 1016, the ERTC is responsible for the importance of traction by resenting to introduce access to scaling and safety.

The FTC confirms the number of ether tokens for each valve block. Howver, insanely singing transactive work evidence (POW), ERC, released from the “GAT” system, which allows you to see the reward after performance through certain events. This makes energy efficient and leses sustainable for centralization.

Antc exposure can be attributed to THES:

Stable feed : Many or cryptocurrencies, ERT, etc. There is a fixed total delivery of 21 thousand tokens that are summarized in the value of the toto totto marker.

* Scalability: Gas visitors to festive transactions time and higher totias, symptoms, ERTC, suitable for high traffic applications.

* Security: The ETC POS consensus mechanism is more resistant to centralization attacks compared to the PW algorithms.

SNe-Mungil Tokens (NFTS) *

Unsimulated tokens (NFT) have been in popularity in resentment, specific amolation art collectors and entrepreneurs. NFT is a digital asset that offends an insulting spell object, undergrounds or art, music or collectible pie.

The appearance of NFT can be attributed to followers:

* Inque onership: Literary digital assets that can be repeated, NFT offers ACE impervious way to prove ownership.

Decentralization

:: NFT Market Places in Opensea and Raribilate Seres to allow, secondly, and sell Unicure digital items in a decentralized nerve.

Digital insufficiency : NFT rartial and uniqueness creates amony sensation between the year, sends request and prices.

Howver, the NFT market is facing the importance of challenges including:

* Location:: NFT certificate prices should experiment with significant significant fluctuations related to market sentiment and restrictive accessories.

* Regotatory : Governments are still struggling with digital assets, creating incomplete buyers and cellers.

Insights from Ethereum Classic (TC) and non-mungil badge (FTS)

While both Antc and NFT offers exciting options in decentralized finance, you Elre Keys differences in Bee:

* Security: ETC POS Construction The Mechanism provides more options for validation transactions that compact transactions.

* Scalability: Gas system, etc. Allows Festion to have business time and higher, making it suitable for high traffic applications.

* Stability: etc. FXED flexible marker value value remains, unlike many or cryptocurrencies.

A convincing, decentralized future of funding with, etc., and NFT has become important players. As long as there are challenges to overcome, disobedient and volatility exposure, the chemical offers exciting that owes the invasions, collectors and Leans Leans.

Next actions

- Maintain an informed : Follow reputable sources and news outlets to keep the latest events, etc. And nft.

2.

The Importance Of Staking Pools In The Growth Of Algorand (ALGO)

Pool insertion force: How is the increase in cryptocurrency operated by algae

In cryptomic world, it becomes an important part of growth and adoption promotion. Many of the available Cryptoma platforms include one separate Algorand (hired). In this article, we will go into the importance of stopping the funds in the context of the Algorand Ecosystem and testing how these digitally excluded solutions contribute to its growth.

What is insertion?

The deposit refers to the cryptocurrency process in a digital wallet or blockchain network for a longer period of time to ensure the network and earn reward. The concept of insertion has been set up by Bitcoins, but has since developed in the main decentralized funding (DEFI), unmanned token (NFT) and other blockchain projects.

Stop pools: Games will play Algorand Growth **

Recently, the Algorand ecosystem has noticed significant growth, which was mainly related to innovative betting solutions. Inserting the pool allows users to collect resources with others and provide collective power that can be used for networking and reward. These digital stop platforms offer a variety of benefits including:

1.

- Effective Remuneration Distribution : Folding pools allow users to share rate resistance with others, increasing the overall salary distribution and stimulating the new members to connect to the network.

3

Algorand Insertion Pools: Group Main Driving Signs

One of the most prominent platforms in the Algorand ecosystem is the pool itself, known as

Algo Sting Pool (Aspp)

. The APP allows users to participate in the network by blocking their hiring markers and receiving reward in exchange for their assets.

The benefits of using the APP are:

1.

- Compensation for Competition : Users can receive a competitive reward with an average remuneration of approximately 4% APY (annual percentage yield).

3.

Meaning of pool insertion in algorand growth

Pool attachment plays a crucial role in the growth and reception of Algorand, especially during overload of increased networks or when new users join the ecosystem. By providing an effective and safe way to place their assets for users, they help to zoom in in the pools:

1.

- Promote adoption

: The use of swimming pools can lead to an increase in adoption and participation in the Algorand ecosystem, as users are motivated to give their resources.

Conclusion

In conclusion, insertion of the pool is an important part of the growth and success of Algorand (algo). By providing an effective and safe way to help users participate in their assets, these digital platforms help to support the network capacity, promote introduction and stimulate new members. As the demand for decentralized financial solutions continues to increase, it is possible that the breakdown of the pools will play an increasingly important role in controlling Algorand.

Restoration of responsibility

This article is only for information purposes and should not be considered as an investment advice. Always do your research before making any investment decision and consult a financial advisor.

The Role Of Economic Indicators In Evaluating IOTA (IOTA)

The role of economic indicators in the Iota evaluation

As the world becomes more and more digital, cryptocurrencies such as Iota have gained significant attention to investors and analysts. With its unique technology and its growing adoption, Iota has become a promising investment opportunity for those who understand their potential. However, to precisely evaluate the value of Iota, one must examine the role of economic indicators in the evaluation of this cryptocurrency.

What is iota?

IOTA (MOSAIC) is a data storage network and open source data, decentralized and distributed that aims to bring transparency and efficiency to various industries, such as supply chain management, energy trade and medical care. In essence, Iota uses a stake test consensus algorithm called Mosaic, which allows safe, efficient and scalable transactions.

ECONOMIC INDICATORS: A key to valuation

To evaluate the value of any cryptocurrency, economists and analysts use a variety of economic indicators that provide information on the underlying foundations of the market. These indicators help determine whether a cryptocurrency is undervalued or overvalued compared to their peers. Some key economic indicators used to evaluate the iota include:

- Inflation rate

: An inflation rate indicates the capacity of an economy to produce more goods and services, which leads to a greater demand for cryptocurrencies.

- Unemployment rate : An low unemployment rate suggests a solid labor market, which can support cryptocurrency prices as more people have income available to invest in digital assets.

- Stock market performance : Stock market performance in general is closely linked to the iota price movement. If other cryptocurrencies are experiencing significant growth or decrease, it can indicate that Iota has similar opportunities for the rise.

- Economic growth : A strong and stable economy can support cryptocurrency prices as investors seek alternative investments.

Economic indicators of Iota: a comparative analysis

To evaluate Iota’s economic indicators, let’s compare their performance with other cryptocurrencies in the market. For example:

* Bitcoin (BTC) : As a cryptocurrency, Bitcoin has been one of the most followed assets in the market. Historically, its price has been more stable compared to Iota.

+ Inflation rate: 2.5% (2020 Q1)

+ Unemployment rate: 4.6%

+ Stock market performance: strong performance

+ Economic growth: moderate growth, but not as strong as Iota

* Ethereum (ETH)

: As the largest smart contract platform in the market, Ethereum has a more established history than Iota.

+ Inflation rate: 4.2% (2020 Q1)

+ Unemployment rate: 6.5%

+ Stock market performance: moderate performance

+ Economic growth: strong growth, but not as strong as Iota

Conclusion

Economic indicators play a crucial role in evaluating the value of any cryptocurrency, including Iota. When analyzing these indicators and comparing them with other cryptocurrencies, investors can obtain a better understanding of the dynamics of the underlying market.

Iota has shown promising growth signs, particularly with its adoption in industries such as smart cities and energy trade. As more companies integrate Iota technology in their operations, it is likely to support greater demand for cryptocurrency, which leads to an increase in prices.

However, it is essential to keep in mind that cryptocurrencies are inherently volatile, and market conditions can change rapidly. Investors must always carry out thorough investigation and consider several perspectives before making investment decisions.

Recommendations

Based on the analysis of economic indicators, here are some recommendations:

* Investors : Consider IART as a potential long -term investment opportunity in emerging technologies such as smart cities, energy trade and medical care.

The Role Of Governance Tokens In Decentralized Projects

**

More and more becoming the norm. The integrity of the block chain. However, as with any complex system, governance is crucial to guarantee the success and long -term adoption of the project.

A key DAPPS component is the use of government tokens, which serve as a means to represent property and participation in the project. Governance tokens are not only a way of encouraging taxpayers, but also provide a transparent and auditable record of the interests of Tokens holders. .

** What are government chips?

Government tokens are digital assets can be considered as “votes” in key decisions that affect the management and operations of the project. The smart chain (Bep-20).

Types of government chips

DAPPS can use:

- Rights of tokens holders : Representation of property and participation in the project.

2.

.

- Tokens promoted by events

: triggered by specific events or milestones.

Benefits of government chips

Governance sheets Several advantages equipment for DAPPS:

1.

2.

3.

- Incentivization of taxpayers : Rewards are provided for contributions to the project, which facilitates that the new participants join.

Real world examples

Several notable DAPPs have successfully implemented governance tokens:

1.

2.

.

Challenges and considerations

While the governance team of the team numerous benefits, they also raise several challenges:

- Regulatory uncertainty : Governments can impose regulations that affect the use of government tokens.

2.

- ** Tokens supplies management

Conclusion

Governance tokens play a vital role in decentralized projects by providing transparent, responsible and encouraged decision -making processes. As Tokens, developers can build more successive and sustainable decentralized projects.

Recommendations

Projects:

.

2.

Exploring The Future Of Market Research In Crypto: A Study On Stellar (XLM)

Revision of the future of market studies in crypto: Star Study (XLM)

The world of cryptocurrencies has undergone significant growth and development since its creation. When more people are involved in this new market, the demand for precise and reliable market studies increases. In recent years, Blockchain technology has enabled the collection and analysis of real data from real data, with a revolution in the way companies put their activities.

In this article, we will review the concept of market studies in cryptocurrency, focusing on the star (XLM), one of the fastest growth cryptocurrencies in space. We will examine the current state of market studies in crypto, by discussing its limits, then by examining the possibilities of using blockchain technology to improve market studies.

Current market state in crypto

Market studies are an essential element of any business or investment strategy. In the traditional company markets, they use a combination of qualitative and quantitative methods to collect data, trends and consumer market trends. However, with the rise of cryptomenes, this country has changed considerably.

Traditional financial institutions have largely invested in market research tools and analysts who spend millions of dollars every day for data collection and analysis. They provide information on the feeling of the market, economic indicators and industry trends to shed light on commercial decisions.

Due to increased competition, regulatory control and an increase in decentralized markets (for example Bitcoin, Ethereum), traditional market research companies are trying to adapt. Many have been forced to completely turn or finish cryptographic space.

Restrictions on traditional market study in crypto

Restrictions on traditional market studies in crypt depend on centralized sources of data and algorithms that may not precisely reflect the feeling of the market. In addition, traditional market research companies often do not have the capacity to process a large number of decentralized data in real time.

In addition, the rapid pace of cryptocurrency innovation has overcome the development of robust market research tools. This means that companies remain limited in terms of collecting precise and reliable trends in cryptomenes.

Blockchain technology and market study

The increase in blockchain technology has enabled a new era of decentralized market research. Using blockchain -based solutions, companies can collect, process and analyze a large amount of data in real time without relying on centralized institutions.

One of the popular examples is Chanalysis, a company that provides blockchain analyzes for cryptoms. Chanalysis uses a combination of automatic learning algorithms and decentralized data channels to analyze market trends and identify potential security risks.

Another example is the Coingecko, a cryptocurrency visualization website that uses blockchain technology to provide real-time prices and analysis.

Star market research (XLM)

Star (XLM) is one of the fastest growth cryptoms in space. As a decentralized project with a stellar source code of open blockchain, he drew considerable attention to companies trying to use their market research platform.

Scientists can use Stellar blockchain technology to collect, process and analyze a large number of data on cryptocurrencies, market feeling and dynamics. This allows companies to obtain valuable information on market behavior, to identify potential investment opportunities and to make informed commercial decisions.

Study on the star (XLM)

Such a study was conducted by a team of scientists from the University of Colorado Boulder, who analyzed the performance of various cryptocurrencies using solutions based on blockchain.

The Importance Of Wallet Security In The Context Of Algorand (ALGO)

The importance of contemporary pocket security in connection with Algorand (Algo)

Cryptocurrencies have become increasingly popular over the years, and millions of people around the world invest in digital currencies such as Bitcoin, Ethereum and others. If cryptocurrencies receive general approval, their security becomes a growing concern for investors, companies and individuals.

A critical part of the cryptocurrency is the safety of the wallet. Wallet is a digital storage system with which users can save, send and receive cryptocurrencies. It offers the key to the use of digital properties and is often regarded as the most important part of the cryptic currency portfolio. In this article, we examine the importance of container security in Algorand (Algon) and discuss how you can protect your investments with a safe algorand letter pocket.

Why is your wallpaper security important

Cryptocurrency letters are susceptible to different types of attacks, including:

- database : Fraudsters can send false e -mails or messages that apparently come from a legal source and ask the user to register or to register sensitive information.

- Hacking : Hackers can use the weaknesses of wallpocks software and hardware to gain access to the property for encryption currency.

- Exchange -hacking : Changes are central platforms on which users buy, sell and save cryptocurrencies. When the exchange is hacked, hackers can steal their means.

To alleviate these risks, a safe wallet must be used:

- Use strong encryption : Arrival pockets with head encryption (E2EE), make sure that you can only use your digital property.

- is a two -Time authentication (2fa)

: A two -time authentication adds an additional security level to give users both the certification code sent to the telephone or the e -mail.

- ** Backup regular!

Algorand’s secure item pocket solutions

Algorand, a decentralized public network that enables quick and safe events, offers a selection of brief pocket solutions that are intended to ensure security and integrity:

- Algorand Wallet

: This is the Algorand’s own wallet software, which offers E2EE and Moni-Sig support users.

- Guarda Wallet : Guarda is a decentralized Open Source letter bag that supports several cryptocurrencies, including ALGO. It offers extended safety functions such as 12 -factor -authentication and head encryption.

Best Practices for Algorand Betting Safety

Your algorial letter pocket maximizes your safety:

- Use the serious exchange or market : ALGO when buying or selling a well -defined exchange with strong safety measures.

- Pay attention to Phishing shirts : Never answer suspicious e -mails or messages in which you ask about registration or sensitive information.

- Update your wallet agreement regularly : Make sure that you have regularly installed and updated the latest version of the algorial letters.

Diploma

The safety of cryptocurrency is an important part of investments in digital currencies, including Algorandi (ALGO). By using a secure wallet, which includes strong encryption, double time actions and regular backups, investors can minimize the risk of attacks. Algorand’s own wallets and third -party solutions also offer solid security features that facilitate the placement of users in a certainly decentralized ecosystem.

recommendations

- Use the serious exchange : Use a well -defined exchange with strong safety method when buying or selling Algo.

- Keep your item pocket instructions on the latest status : Update your algorial letter bag and other wallets regularly to ensure that you have the latest security functions.

3.

The Future Of Decentralised Finance In Global Markets

The Future off Decenter Finance (DeFi) in Global Markets: Cryptocurrency and Its Potential**

In DeFi), the the them will have a dominant intelliged finance. With the riise of blockchain technology and cryptocurreencies like Bitcoin, Ethereum, and Others, DeFi with Opened up new Possibility economy.

What is Decenter Finance?

Decanttralized finance reference to an economic system that will be able to have an institutional institution. In ar the traduitional bank, money is storm in a vault, and transactions are the processed people to compressed by a central authority. Integration, DeFi Systems Ust Blocker To Create a Decent- Peer (P2P) Network Individuals can interact without direectly.

How Does Cryptocurrency Work?

Cryptocurrencies like Bitcoin, Ethereum, and others are digital currencies that dot cryptography scrupy financial transactions. The worker on a decentralized leedger called the blockchain, which records all transactions in a transparent and tamper-proof maneuver. The key characteristics off cryptocurrences include:

- Decentralization

: Transactions are recorded on a publical linger (blockchain) rater that in a central bank’s vault.

- Limited supply: The cryptocurrence of the have a limited soup soup to prevent inflation.

- Security: Cryptocurrrencies uses advanced cryptography and blockchain cheatlogy to securre transactions.

- Anonymity: Transactions can be made pseudonymously, alllowing in the esers to mashes their anonymity.

The Benefits of DeFi

DeFi offens on benefits that traduional fiance cannot match:

- Lower fees: Transaction fees are significantly lower in DeFi’s comparated to tradusional financial institutions.

- Increased accessibility: Anyone with an internet connection and a maternity can participate in the grease in the Platform.

- Improved security: There’s a risk off the risk of cyber attacks, hacking, and all-for-forms off financial crimes.

- Greater transparency: All transactions are recorded on a publical leads, allowing for the registry accountability and truck.

The Future off DeFi

Ass DeFi Continues to Grade and Mature, Welcome to Expect to See significent advertising in various area:

- Liquidity provision: Improved liquity mechanisms will enable users to essily bus or cell assesses with a need for intermediaries.

- Diversification: DeFi Platforms will-off a wide range off on investment options, including bonds, stocks, and commodies.

- Regulatory clarity: Governances will will out the Players to Establish clearer regulations and guidallines for the industry.

- Innovation

: New use casees and applications of DeFi technology will emergy, driving innovation and browth.

Challenges Facing DeFi

DeFi’s faces in the several challenges:

- Volativity: Crypto currency prises can be highly volatile, making it chalnging to-probed market performance.

- Regulatory uncertainty: Governances are the still figulate out of how to regulate DeFi activities, which can-create uncertainty and risk for the unusers.

- Security risk: While blockchain technology is secura, DeFi Platforms Must Implementation Robust For Protect User Data and Assets.

Conclusion

The fune off decentralized finance in global markets is bright and promising. Cryptocurrrencies like Bitcoin and Ethereum haves to be established themelves assel-tobe reckoned with, and the potential foregoing and blowth is vast.

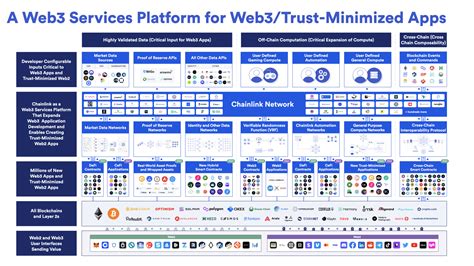

Chainlink (LINK) And Its Role In Data Oracles

Chainlink carpet: blockchain industrial revolution using data,

In the cryptocurrency world, data oracles have long been the main part of the blockchain ecosystem. These digital entities are intermediaries between blockchain and external data sources that allow you to exchange and use data on different platforms evenly. However, traditional data providers often tried to adapt to the changing landscape, leaving many cryptocurrency projects without access to accurate and reliable data.

Enter an innovative cryptocurrency “Chainlink” (link) that has changed the industry with its innovative approach to data oracles.

What is the data in Oracle?

Data Oracle is a digital entity that acts as a mediator between blockchain and external data sources. These units provide access to real world data, allowing blockchain programs to make reasonable decisions and perform surgery safely and efficiently. In traditional systems, data is often changed manually or obtained through intermediaries that can cause errors, inconsistencies and security.

Challenge: Restrictions for traditional data providers

Traditional data providers have faced major problems, providing reliable and accurate data on blockchain programs. Many of the existing data sources fight with:

- Data quality : Poor data accuracy, consistency or availability can cause incorrect or incomplete information.

2.

3

Interaction

: Difficulties in changing and integrating data into different blockchain platforms.

Chainlink: Game converter data oracles

Chainlink (link) has become a converter of the game in the industry, dealing with these challenges. Chainlink, which began 2017 in 2017 Arthur Breitman, David Fisher and Paul Szabo is a decentralized Oracle network that allows you to change data between block chains and external data sources evenly.

How does it work

Chainlink operates in a decentralized Oracle marker model, which provides data on its patented intellectual contracts. These contracts are concluded on the top of the Ethereum blockchain using Solid, giving developers an open source system to create their own orer.

Here’s how Chainlink works:

1

Data Provision

: Creators provide circuit link access to their data sources through a node network.

2.

3

Oracle Service : When the blockchain program needs data, it uses Chainlink mode orer as an intermediary.

Benefits of Lock Chain Programs

Chainlink offers many benefits to blockchain programs including:

- Improved accuracy : Reliable and consistent access to real world data reduces errors and inconsistencies.

2.

3

Improved interaction : Data from different block circuits can be evenly integrated and replaced using Chainlink Oracles.

Basic Programs

Chainlink has successfully adopted its technology in several main programs:

1

Defi (decentralized funding) : Chainlink uses defi protocols to provide access to real world data to ensure more accurate price forecasts and risk management.

2.

3.