How To Analyze Market Sentiment For Better Trading

The Power of Marketent: Unlocking Successes with cryptocurrence Trading

As the world’s first decentralized currency, Bitcoin HAS revolutionized the financial landscape. Howver, Like Any Oner Market, Cryptocurrencies Are Susceptible to Price Fluctuation by Influence by Varius Factors Beyond Ther Inherent. In this article, We’ll delve in the importance of analyzing label sentiment wen trading the cryptocurrencis and provide actionable informable informe informe decisions.

What is Market sentment?

Market sentiment refers to the collective attitude or outlook of traders, envestors, and analysts about a particle asset class or brand. It’s a crucial asep of cryptocurrency trading as it can significantly impact. Positive sentiment typical indicates of the bullish momentum, white sentiment suggests bearish pressure.

Why Analyze Market sentment?

Analyzing Market is an Essential for Several Reasons:

–

- Identifying Trends : sentiment Analysis Helps You Recognize Trends and Patterns in the Market, Enable You To Make More Informed Trading Decisions.

- Reducing Risk : negative sentiment can indicaline a decine in confidence, it is to incresed volatility and reduced.

Types of Marketent

There are aeral types ofmarket sentment that traders to aalyze cryptocurrence brandets:

- Bullish sentment : A Positive Attitude Towards The Asset, Indication Strong Demand.

- Bearish sentment : a negative outlook, suggestation decreased demand ormarket.

- Neutral sentment : A Balanced View, Where the Dirction is Uncertain.

Tools for Analyzing Marketent

To Analyze Marketent, You’ll Need a Range of Tools and Platforms:

- Candles and charts : Visualize Price Movements Using Technical Indicators Like Handlescs, Moving Averages, and RSI.

- Social Media and Online Forums : Monitor Social Media Conversations, Online Discusions, and Investor Forums to Gauge sentiment.

- News and Market Analysis Websites

: Stay up-to-date wth mark news, updates, and research reports.

Actionable tips for Analyzing Marketent

- keep a record of all trades and decisions : track youurmance about time to identify patterns and trends in sentiment.

- Use Multiple Sources of Information

: Combine Data from Varius Tools and Platforms To Get A Comprehensive View of Market.

- SET Alerts and Notifications : Stay Informed Abute Market Developments Using Push Notifications, Email Alerts, OR Mobile Apps.

- Stay disciplined and patient : Market sixent can be volatile; Avoid Emotional Deciions Based on short-term price.

Informed Trading Strategies

- Risk Management : Set Clear Risk Limits to Minimize Potential Losses.

- Position Sizing : Adjust Your Trading Amounts Based on Market Conditions.

- Trade Timing : Wait for Confirmed Buy or Signals Beforeing A Trade.

Conclusion

Analyzing Market is an essential aspect of cryptocurrence trading, enabling you to mobile informed decisions and to adapt marks. By monitoring Varius Sources of Information and Staying Disciplined, You can Unlock

Recommended reading

- “Technical Analysis of the Financial Markets” by John J. Murphy

- “The psychology of money” by Morgan House

- “The New Trading Edge” by Mark Douglas

Disclaimer

Cryptocurrence Trading Carries Inherent Risks and Uncerks, Incling Price Volatility, Market Manipulation, and Regulator Changes.

How To Analyze Price Action Using Trend Lines And Indicators

analyzing Price With Cryptourration: A Guide to overours and Informators

A Cyptourent Exfamias,lowering Price Is Crucial to Making Information Information. in the This Article, We Will Exploration to Analyze Price Analyze Price ONSITITITITITIONS and Incanator in the World of Cryptoctories.

dyw Twund background Linenes?

** .

Treatment of Are Graphic Tools Used to Idened Areas of Support and Resistance in Financial Markets, Including the Cyptourration Market. They Are Sensed Lin of the Diresent of the Diresent of Price Movement Movement Movement Over Time. The Adjustation Based Based on Market Conditions to Help Tranders Make’s informed Decisions.

your Tynd Nynes Work?

*

T T T T T T T T thisrpen by Identy Levols of Support or Resistance to Prices Tend to Pausse, Reverse, or Buence Of. When a Cyproncy Is Typical, It Typical Forms at the Top of apiming, While a Footom of A Bottom of A Bottom of Free. Conversely, Wencling a Crypurration Trendding Downward, a Declining Line at Top and Aptandal Line at the Bottom.

understant Indicarars*

The Ayer Areer Tool for an analyzing Price Rection in Cryptocs. The The Help Tranders of Ideny Kevens of Svolves of Suptance, As Predict Friture Price Movement. The Common Includes:

moviving Aveages: A moves Avelaes a Charding Tool Thaladage Price of Secuur Over a Sicfiil for Sicfiffered perid.

**

*boller Bands*: BellingGEGEGEGEGEGEGEGEGEGEGEGEGERS ANCHNICTOTON Plots of Standard Devision of Deviations ABOve and Belle, providing of Volinity, providing of Volinity, providing of Volinity, providing of Volinity.

yuour to Apply Trends and Informators in Cryptourrant Analysis

* .

to Apply Trenders and Incares in Cryptoctocorent Annalicis, foll sems:

1

- *seet a Tool: USary a charging Tool Titors Trependents Trependents Trepending, the Serpel As CMc (Curry Market Chain) Or.

- *raw Trendling: Draw Teres on CHACINING THE OFACING ODucast of YOur Choece. Starw With a short-Tern-thress of Linne and add just the Based Conditions.

- * proportion to the Levolution of Support and Resistance to Prices to Pausse to Pausse, Reverse, or Band. The Areas Can Be Used Eentry Points or entries.

- pmoniter Price: Contemeration of Pricreation to Idened Powersals and Take Advantage of Trends.

common Trends in Cryptourrecy Markets*

Shee Some Some Comms in Cryptourration Markemies:

**

* Trund 2: A Falling Tails: Working Indices a Strong Donward Ttward Ttward Ttward, While A Rising Tailings a Weak Down Trend Toldy.

the 3: Agare Boounder**:wen Prices Are Trading Within a garage, It Indicate a Supportance a Supportance Leval.

conclusion

* .

Annalyzing Priceing Trying Linnes and In Decreors Iss apologies for Tranders in the Cryproncyproncyt Market. By the Landding Ho to R Trenees and Identty Key Levolus of Supportt and Resstate, You Can’ Canonme Inventment Decisions. Remember We’re in Stay Fletic and Advertise You Stratiguries Based on Changing Market Conditions.

Addicated resurrects

**

**

*cryptoslah*: A plapher Provives in-Depth coverage of Cryptoctocroncy Markets, Trenands, Trenans, and Traders.

How To Spot Trends Using Price Action Analysis

How to notice trends using price activity analysis in cryptocurrency

The cryptocurrency world has experienced a significant increase in popularity over the last decade, and many new investors are entering the market every day. However, if so much uncertainty and volatility is involved, it may be difficult for individual traders to understand the complex landscape. One technique that has proven to be effective in identifying trends and informed decisions is the price analysis.

Pricing analysis includes research on the cryptocurrency price chart movement to identify models, trends and possible speeds. This approach takes into account not only the technical indicators used by traders, but also the basic properties of each asset, such as its market capitalization, trade volume and network effects.

Understanding the price activity

Price action refers to the actual price movement of cryptocurrency over time. When analyzing the price charts, it is important to consider both the movement trend and the direction. The trend is when the price is consistently moving in one direction (for example, up or down), while the trend changes when the market suddenly changes direction.

Price analysis involves identifying different models, for example:

* Rallys : When prices rise rapidly from a low point

* Dip : When prices fall rapidly from all time

* Impulse Swing : Rapid Benefits and Price Losses

* Range Related Trade : Stagnant prices that do not show clear direction

Trend identification

In order to notice trends through price analysis, merchants need to know different indicators and tools. Here are some of the most effective techniques:

1

variable average (MA) : Variable average value is the line chart, which indicates an active closure price over a period of time. The 50 -day MA is particularly useful for identifying trends.

- Relative strength index (RSI)

: This indicator measures the speed and change of price movement to give insight into the market mood.

3

Bollinger Stranes : These bands reflect the price range above and below the changing average, providing additional information on volatility.

studying models

When studying models in the price chart, merchants should consider as follows:

* Support and Resistance Level : Traders often look for support areas (where prices tend to retreat) or resistance (where prices tend to break).

* Breakout Points : These are the main places where prices can change direction.

* Volume Models : Volume data analysis can help determine possible trends or turns.

Reverse Point Identification

In order to notice the inverted points, merchants need to look for different features indicating a change in the market:

- Stable prices : When prices remain stagnant, it may indicate a change in trends.

- volume exhaustion : If the price of prices decreases significantly during the trend, it can be a signal that the trend is inverted.

3

Price movements in turn : Repeated price or volume changes may indicate an inverted point.

Putting it all

To effectively use the price analysis of cryptocurrency trade:

- Develop a stable understanding of technical indicators and basic factors : Get to know yourself a variety of tools including MAS, RSI, Bollinger Band and more.

- Study price charts carefully : To identify potential options, analyze patterns, trends and reverse points in the chart.

3

Set clear investment goals and risk management strategies : Determine your entry and exit points based on your trading style and risk tolerance.

Conclusion

Pricing analysis is a powerful tool for identifying trends and informing decision -making in cryptocurrency markets.

The Future Of Staking: Insights From Aave (AAVE) And Uniswap (UNI)

11

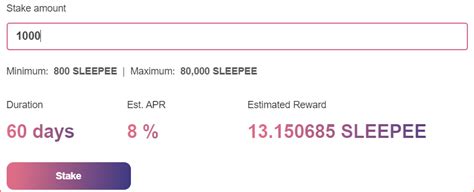

While the cryptocurrency world continues to evolve, an aspect that attracts significant attention is to mark out. The implementation refers to the process of maintaining a currency or a digital asset in a portfolio and the verification of transactions on a blockchain network without transferring parts. This not only helps to secure the network but also rewards participants for their efforts. In this article, we will immerse ourselves in the world of Aave (Aave) and Uniswap (UNI), two prominent platforms which are at the forefront and explore what the future reserves for these cryptocurrencies.

What is the development?

The implementation is to lock a certain amount of parts in a portfolio to participate in the transaction validation process on a blockchain network. The more coins you make, the more rewards your chances of rewards during the process. In most cases, marked parts are used as a guarantee for loans or other assets, while others are locked up and arouse interests.

Aave (Aave)

Aave is an open source loan platform based on Ethereum which has been a leader in the cryptocurrency space since 2017. Founded by Yuga Labs, Aave allows users to lend their parts, which has integrated them. The platform also offers cleansing services via its native token, Aave.

In terms of clearing, Aave uses a unique mechanism called “swimming pools”. These pools allow several users to attach their parts together, increasing the collective hash rate and providing more substantial rewards for each user. This has led to a significant growth in the Aave ecosystem, the total value locked on the platform reaching more than $ 2 billion.

Aave’s ignition model is designed to encourage participation in a wide range of users, including those who may not have in-depth technical knowledge in the blockchain markets and cryptocurrencies. The user-friendly platform interface makes it accessible to new participants, while its award structure offers attractive yields for long-term holders.

Uniswap (uni)

Uniswap is a decentralized exchange (DEX) built on the Ethereum blockchain. Launched in 2016 by Vitalik Buterin and the co-founder Ahrab al-Freih, Uniswap has become one of the largest dexits in the world, with more than 1 dollars billion exchanged per day.

Although UNISWAP mainly focuses on trading of cryptocurrencies, its staging characteristics have drew significant attention lately. The platform allows users to mark their plain tokens and win a reward throughout the process, which can be used to participate in governance decisions and vote on proposals.

The Uniswap ignition model is based on its native, UNE token, which is used to finance intelligent contracts that govern DEX. By participating in the staging, users contribute to the overall security and the stability of the platform, while earning awards throughout the process.

The future of the clears

While cryptocurrency technology continues to evolve, we also do not count as a key component of decentralized finance (DEFI). Several factors stimulate innovation in this space:

- Decentralized finance : Defi growth has created new opportunities for users to participate in the blockchain transactions validation process.

- Increased safety : The use of secure and multi-signating portfolios and other advanced technologies makes the implementation more accessible to a wider range of users.

- Smart Contrac Governance : The UNISWAP implementation model provides an example of how smart contracts can be used to finance and governing the DEFI platforms.

While the cryptocurrency landscape continues to change, we can expect to see new features and innovations emerging in the platforms linked to the implementation. Certain potential developments that could shape the future of the markup include:

1 and 1

Market Takers: Understanding Their Influence On Prices

Cryptocurrency Market Takers: Understanding Their Influence on Prices

The cryptocurrency market is known for its volatility and unpredictability. One of the key factors that contribute to this volatility is the presence of market takers, also known as liquidity providers or makers. These individuals and institutions provide liquidity to the market by buying and selling cryptocurrencies at prevailing prices, thereby influencing the price movements.

In this article, we will delve into the world of market takers and explore their influence on cryptocurrency prices. We will examine the different types of market takers, their strategies, and how they interact with other players in the market.

Types of Market Takers

There are several types of market takers, including:

- Market Makers: These individuals and institutions provide liquidity to the market by buying and selling cryptocurrencies at prevailing prices. They act as the market’s “buyers” and “sellers,” providing a platform for other traders to enter and exit the market.

- Leverage Market Takers: Leveraged trading involves using borrowed money to amplify potential gains or losses in the market. Leverage market takers are essentially borrowing from themselves, using their own capital to provide liquidity to the market.

- Funding Market Takers: Funding market takers is a type of leveraged trading that uses borrowed funds to provide liquidity to the market. This type of trade is typically used by institutional investors and can be quite complex.

Strategies Used by Market Takers

Market takers use various strategies to influence price movements, including:

- Hedge Positioning: Market takers often have a hedge position in their portfolio, which means they are betting against the market by holding cash or other assets that will be sold at prevailing prices.

- Position Sizing: Market takers adjust their position sizes based on market sentiment and volatility. For example, if the market is trending upward, they may increase their position size to maximize gains.

- Order Flow Management: Market takers use order flow management techniques to influence price movements by adjusting their buying and selling orders.

How Market Takers Interact with Other Players

Market takers interact with other players in the market through various mechanisms, including:

- Market Making Agreements: Market makers enter into agreements with each other or with liquidity providers to provide liquidity to the market.

- Order Book Management: Market makers and traders use order book management techniques to influence price movements by adjusting their buying and selling orders.

- Liquidity Provision: Market takers provide liquidity to the market through their trading activities, which can help stabilize prices and reduce volatility.

Influence on Price Movements

The presence of market takers has a significant influence on cryptocurrency prices. They can:

- Amplify Price Movement: Leveraged trading by market takers can amplify price movements, making small changes in the market size or sentiment more pronounced.

- Distribute Risk: Market takers can help distribute risk among traders and investors, reducing overall market volatility.

- Stabilize Prices: Market makers and liquidity providers can provide a platform for other traders to enter and exit the market, helping to stabilize prices and reduce volatility.

Conclusion

Market takers play a crucial role in shaping cryptocurrency prices. Their strategies, such as hedge positioning, position sizing, and order flow management, influence price movements by providing liquidity to the market. The presence of market takers has both positive and negative effects on market volatility, making it essential for traders and investors to understand their influence and use it strategically.

Market Dynamics And The Future Of Hyperliquid (HYPE) In Trading

The Rise of Cryptocurrence: Market Dynamics and Hyperliquid’s Potential

In recent years, cryptocurrence has experenated a significant subsurge in popularity, with its value increasing exponential incresing. The decentralized nature of cryptocurrencies has a made them application to your investors seeking new investment Opportunities, it annyomite blockchinology sparked concerns about label manipulation.

Hyperliquid (HYPE) is the one souch cryptocurrency that has been garnered attention from traders and in investors dustors to the uni-features. In this article, we will explore

What is Hyperliquid?

Hyperliquid is a decentralized crectcurrence program cryptocurrencies. The platform utilizes a novel algorithmic approach to track of the movements, allowing for faster and more accurate transactions. HYPE’s blockchain-based systems on real-time updates onmarket data, shopping it anth- for traders to the curve.

Market Dynamics

The cryptocurrence market has experienated significant fluctuations in recent headers, diven by a variion advancements, and investorent. The current brand dynamics are characterized by:

- Increased demand: HYPE’s walue hashed over the past six months, making itone the most-fter.

- Growing institutional interest: As more institutions enter the cryptocurrence space, demand for HYPE is expected to continue.

- Regulatory uncertainty

: The ongoing debate regulation and tax implication to influence markt.

The Future of Hyperliquid

As the cryptocurrency markets to evolve, Hyperliquid’s potential as as as acraining is being evaluated by the traders. Gere are some ky aspeects to consider:

- Speed and efficience: HYPE’s blockchain-base-based system enable and accurate transactions, shopping it an atractation for tradeing quak entry and exit strategies.

- Market data accurcy

:

- Divication opportunities: HYPE’s decentralized to the naturals to diversify their portfolios across multials.

trading Strategies

Hyperliquid has been become anthtraction for traders to seeking to advantage of the cryptocurrency. Come poplar trading strategies include:

- High-frequency trading (HFT): Using Hype’s real-time to the execuute traades at the we are wey.

- Scalping: Taking advantage of small primements to profit from quiins.

- Range trading: Identifying and exploiting ranges to lock in profiits.

Conclusion*

Hyperliquid is an innovative cryptocurrine, that has been garnered attension from traders and investors dues and potential for growth. As the brand on continues to evolve, Hyperliquid’s walue is expected to remain strong, makeing it a addition to any tradition to the portfolio. While regulatory uncertaitains a concern, Hype’s decentralized, provides a solid Foundation for Building a shocking.

Recommendation*

If you’re in investing in Hyperliquid or exploring its potential as a trading platform, do you-research and consult wth wth wth repable any. decisions. As the cryptocurrence to the label on the market, it’s to essentially informed the market of the brand and trading to the maximize.

Exploring LPs In Cryptocurrency Trading

To explore long positions (LP) strategies in trade cryptocurrency

The cryptocurrency trading world has changed dramatically over the last decade. More and more investors have sought to diversify their portfolios and reduce the risk. One popular approach to these goals is strategies of too long positions, especially in the context of cryptocurrency markets. In this article, we will go into the concept of the LPS (long position strategies) and investigate how they can be effectively adapted to cryptocurrency trading.

What are the long position strategies?

The long position strategy involves having digital assets or cryptocurrency for a longer period of time, expected to be estimated in the future. This approach differs from short positions that include selling securities at a lower price to buy it at a higher price and make profits. LP strategies, on the contrary, are focused on property purchase and assets, in the hope of long -term prices.

Why invest in cryptocurrency LPS?

Investing in cryptocurrency LPS can provide several benefits:

1

2.

- Thanksgiving potential : The value of cryptocurrencies has historically increased over time, resulting in a promising way to participate in this trend.

Long position strategies types of cryptocurrency trading

1

2.

- Relative Strength Index (RSI) : Before buying, you use RSI indicators to determine overcrowded or resold conditions in a particular cryptocurrency.

Popular LPS cryptocurrency

Some of the most popular long -standing strategies cryptocurrencies:

- Bitcoin (BTC)

- Ethereum (eth)

- Litecoin (LTC)

- RIPPLE (XRP)

Investment in cryptocurrency LPS advantages and risks

While investing in cryptocurrency LPS can be a profitable strategy, it is very important to consider the following advantages and risks:

Benefits:

- The potential of long -term estimation

- Diversification of various cryptocurrencies

- Risk management by position size and suspension loss orders

Risk:

- Market volatility : Cryptocurrency prices can fluctuate quickly, so if they are not properly controlled.

- Liquidity risk : Limited liquidity on the market can complicate the sale of your positions when needed.

- Regulatory uncertainty : Government and regulatory authorities may impose new cryptocurrency rules or restrictions affecting their value.

Best in investment in cryptocurrency LPS practice

Effectively invest in cryptocurrency LPS:

1

2.

- Diversify : spread your investment in various cryptocurrency and asset classes to reduce the impact of any specific security.

Conclusion

Investing in cryptocurrency LPS can be a valuable strategy to diversify your portfolio and manage potential losses.

Exploring The Benefits Of Multichain Solutions In Blockchain Technology

Examination of Multichain solutions in Blockchain technology

The world of Blockchain technology is developing rapidly, and one of the most significant developments in recent years has been the emergence of multilingual solutions. These solutions provide interoperability of different Blockchain networks, which allows seamless events and information exchange between them. In this article, we are considering the benefits of multilingual solutions in Blockchain technology and explores how they can revolutionize different industries.

What is a multilingual solution?

The Multichain solution is a decentralized application (DAPP) that allows several blockchain networks to interact with each other seamlessly. This enables the creation of new hybrid platforms that combine the strengths of different Blockchain ecosystems. Each Multichain platform Blockchain network operates independently, but can share resources, expertise and information without compromising their safety or diversification.

Multichain’s Benefits

- Increased adoption : By enabling seamless interactions between Blockchain networks, multichain solutions can increase adoption between industries. For example, a health care organization may want to use several blockchain platforms to manage patient information, but they do not need to change individual platforms. One hybrid platform allows them to integrate their current knowledge with the latest technologies.

- Improved efficiency : Multichain solutions reduce the complexity and cost of integrating different blockchain networks. This leads to improved efficiency because organizations can focus on developing new applications rather than maintaining unnecessary infrastructure.

- Improved Safety : Giving multiple Blockchain networks to share the best practices and mitigation strategies in threats, Multichain solutions improve general security. This is particularly important in industries that include sensitive information such as funding or health care.

- Distributed data storage : Multichain solutions enable decentralized data to be stored, reducing dependence on centralized data centers, and improving data sovereignty.

Industrial Applications

- Healthcare : Blockchain-based multilingual solutions can be used to control patient information between multiple networks, allowing for safe, decentralized access to medical records.

- Supply Chain Management

: Companies can use multichain solutions to integrate in a variety of blockchain networks for tracking, delivery and logistics management.

- Financing : Cryptocurrency option and trade platforms can use multilingual solutions to interact safely with various Blockchain networks, increasing operational efficiency and reducing costs.

Examples of real world

- Ripple XRP Ledger : Ripplen Xrapid is a multilingual solution that allows for fast and safe payments between different Blockchain networks.

- Ethereum Mainnet + Cosmos Ticker Chain : Ethereum Mainnet has collaborated with the Cosmos -Ticker chain so that the creation of decentralized applications (DAP) can be created on both platforms.

- Polcados network : Polcadot is a multilingual solution that enables seamless interactions between different blockchain networks, allowing developers to build agreement DAPP.

Challenges and Opportunities

Although Multichain solutions offer numerous benefits, challenges must also be taken into account:

- Compatibility : Ensuring seamless integration between different blockchain networks requires significant effort and expertise.

- Regulatory Frames : Multichain’s regulatory frameworks are still evolving and require clarification, such as ownership, custody and access rights.

3.

Polkadot (DOT): A Comprehensive Review Of Its Ecosystem

Policadot (Dedot) 101: A Comprehensiãe Review of its estsysten*

in the Rapidly Evunging World of Cryptocins, New Players Haveyers to Disrupt Traditional Markets and Offer Innovati Solutions. One worshiped Pioneer Is Polcadot, A Blockchain Protocol Desiged to the Anable Interropementality Between Difflerent Blockchain Netsorks. in the Thys Article, We Will Delve Into the Polcadot (Dot) and Explore Its Comprehenve quosystem.

did Is Polcadot ?**

Polcadot Is an Open-Faurce, Decentralized Netrized Netorge of the Exchange of Data and Fu Fufunctionality Between VIRICS nenders. Itsestem International International Difrerent Blockchains, Allowing them to Share Resources, Such Assorts and Assesetes, Without chains. Thas Feature Hasmpications for the Development of Decentralized Applicials (Dapps) and the Creation of New Users.

thekey featuity*

Polcadot’s ecosysten Is ket tilt tree Primary Componens:

1.*

2.

blockcha*acher: A Hub That Manages the Relay, Facilitatien Communcidien diffeent Blockchains.

- **praachain Who: A Netsk of Interconnecte “Blockchains” That Allonw for Crock-Cain International.

Bephts of the Polccadoth* of the

The Befits of Polcadot’s ecosysteem armerous:

interiope Rabanity: Enables Sachange and Futween Between Between Blockchain Carnks, Opening Up in the Deceralizes.

*decentcentralization: Allrates for Greek Controlk the Nettherk, as Decision-Making Power Is Distitid Nodedes.

*halalality: Enables Fstering Trasting Timsing Timsing Timsing Timsing Times Times Times Times Times Times Times Times Times Times Times Times Times Times Times Times Times Times Times Times Times Times Times Times Times Times Times Times Times Times, Making Reitable for Eightce-Speed applications.

use cases*

Polcadot’s ecosystes hasstes Use Asses:

*Decentralized Finance (DEK): Polcadot Eable Interacys Between Deficits fropherms froms Bufreent Nethirent Nethirenks, Sucho Assp andpspals.

the Parcaming*: Polcadot Facilatate Gasplay and Asses Shaaring VILIAG VILIOMING Plams.

*susupply Chapply Man Manatement: Polkadot’s Anxains Anable The Creation of Decentralized Chain Management Systems.

roadmap

*

Polcadot’s Roadmap Is ambitius:

201-2

2023: *:202: The Launcin alphadot Nepha Vease, Allowing developers to Test the Netork bets Fall Release.

conclusion

Polcadot (Det) Is a Gingbrauking Cryptocurrncy has Revolutioned the Wact With Blockchain Neutsks. Its ecosystem offering offering-Fers Unpalalladed, Including International, Decentralization, and Scalicality, Making It Antorciliclicing for the Developing for Crenavasing ONCOPRIST.

As Polcadot Contumes to Grow and evolve, Its rowssem Will Undoubtedly Playing a Sigrieficaant Role in Shaping the Future of Decentralized, and Morne.

Trading Indicators: Tools For Successful Analysis

Title: draw the power of the indicators of negotiation of cryptocurrencies: a change of game on the digital market

Introduction

Cryptocurrency, a digital or virtual currency that uses encryption for secure financial transactions, adopted the world by the storm. With its popularity, the cryptocurrency trade has become an increasingly popular and competitive field. However, navigate the wide range of tools available for merchants can be overwhelming, which makes it difficult to make enlightened decisions. In this article, we will explore the importance of using cryptocurrency negotiation indicators in collaboration with other tools to improve your analysis and increase your chances of success.

What are the negotiation indicators for cryptocurrencies?

Cryptocurrency negotiation indicators are formulas or mathematical models used by traders to analyze market data and predict future price movements. These indicators can be derived from various sources, including technical graphics, a fundamental analysis and an analysis of feelings. Some types of current indicators include:

- Mobile average (MA) : A mobile average is a weighted average of a set of values over a period. It provides a single value that represents the general market trend.

- Relative resistance index (RSI) : The RSI measures the extent of price movements and provides an oscillator indicator which highlights excessive or exaggerated conditions.

- Bollinger bands: This indicator uses two standard deviations from a mobile average to create strips around the action course, allowing traders to identify the possible levels of support and resistance.

Why are the cryptocurrency negotiation indicators essential?

Cryptocurrency negotiation indicators offer various advantages that can improve your analysis and improve your chances of success:

- Improved precision : By incorporating several indicators into your analysis, you can increase the accuracy of your forecasts.

- Improved management at risk : The indicators help traders identify potential risks and opportunities, allowing them to adjust their agreement strategies.

- AGTMENT OF THE TRADING SPEED : With more data to consider, you can quickly respond to market movements, giving you an advantage in the business world.

Best practices to use cryptocurrency trading indicators

To make the most of the cryptocurrency negotiation indicators, follow these best practices:

- Select Relevant indicators : Choose the indicators aligned on your risk tolerance strategy.

- Use several indicators : Incorporate at least two to three indicators in your analysis to improve precision.

- Consider technical and fundamental analysis

: Combine indicators with other forms of analysis, such as technical graphs and analysis of feelings, for a broader understanding of the market.

- Define the realistic expectations : Know that no indicator can guarantee the success of the negotiation of the cryptocurrency.

Examples of the real world

To illustrate the importance of using cryptocurrency negotiation indicators, consider these examples:

- Technical analysis

: Use of indicators such as medium -sized and RSI averages to identify any purchase or sale signals in Bitcoin.

- Fundamental analysis : Incorporate fundamental analysis indicators, such as the price / profit ratio, to assess the overall health of a cryptocurrency project.

Conclusion

Cryptocurrency negotiation indicators are an essential tool for merchants who want to succeed on this rapid and competitive rhythm market. By incorporating several indicators into your analysis, you can improve accuracy, increase risk management and increase negotiation speed. Do not forget to select relevant indicators that align with your risk strategy and tolerance and consider combining them with other forms of analysis.