Understanding Futures Premium In Crypto Markets

Understanding the future of premiums in the crypto markets

The Crypto Currency World has recorded a significant increase in trade activities in the past decade, and many investors want to profit from the huge occasions offered by this market. One key concept that played a key role in shaping the landscape of cryptocurrencies is “Futures Premium”, which refers to the expansion between the price of the property and its expected return.

What is the future premium?

In traditional markets, such as the future of contracts or inventory options, there is a fixed rate without risk applied on both sides of the trade. This means that the buyer pays the premium (or without risk) for the privilege of taking this risk, while the seller receives the same refund, regardless of the outcome.

In cryptocurrency, however, things are not so simple. The price of the CRIPTO currency largely determines market power and there is no fixed rate without risk. This has led to a situation where investors seek alternative ways to protect their bets against potential losses or gains in the cryptocurrency markets.

Futures Premium in cryptocurrency markets

Futures premium, also known as “widespread” or “premium for volatility”, refers to the additional refund that investors seek from investing in the crypto currency beyond what is reflected on its current price. In other words, investors are an additional profit that are willing to pay the privilege in accordance with the Crypto Currency Agreement.

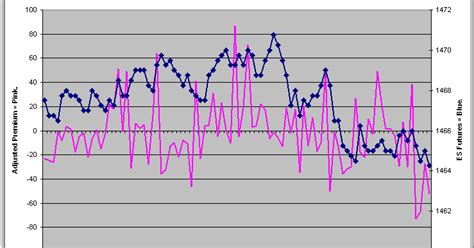

To illustrate this concept, consider the example of the Bitcoin Futures Agreement. These contracts allow traders to bet on the future price of bitcoin. The spread between the current price and the expected yield (or “premium for volatility”) is usually in the range of 0.5% to 2%, depending on market conditions.

For example, if Bitcoin prices are traded at $ 30,000, the merchant could be willing to pay an additional $ 15 per unit (0.5%) for the privilege of maintaining the Bitcoin Futures Agreement with a $ 25,000 strike (expected return). This represents an additional 1.25% profit from the current market price.

Types of Future Premium

There are several types of future premiums that investors can seek in the cryptocurrency markets:

* Premium volatility : This is the most common species, where traders seek to protect from potential losses or gains due to changes in the market volatility.

* In -risk interest rating : Some investors may seek a larger return of their investments, often called “risk -free interest rates”, investing in a crypto currency that are not supported by any tangible property.

* Premium time decay : This type of premium reflects an increased risk associated with the keeping of the cryptic currency over a long period, since the price is more likely to decline over time.

Impact on cryptocurrency prices

Futures premium has a significant impact on cryptocurrency prices. Enabling investors access to alternative ways to protect their bets from potential losses or gains, this can affect the market dynamics in several ways:

* Volatility reduction

: lower premiums means that merchants are more prepared to take the risk and invest in the CRIPTO currency, which can lead to increased prices.

* Increasing participation : higher premiums encourage investors to participate in the market because they seek to profit from potential gains.

* Change of behavior in the market : Futures premium can affect the amount of trading, liquidity and overall market feelings, which affects the direction of cryptocurrency.

Conclusion

Understanding the concept of futures premium is necessary for investors who want to move around the complex world of the crypto currency.

Leave a Comment