Market Depth Analysis In The Context Of Cardano (ADA)

Here is a comprehensive article on market depth analysis in the context of Kardano (ADA):

Market depth analysis: insight into the keys of cardano potential

In recent years, cryptocurrencies have paid considerable attention from both investors and traders. These include Cardano (ADA), a decentralized, open source blockchain platform, which aims to provide a more sustainable alternative to traditional cryptocurrencies. One of the main metrics to which the cryptocurrency space is important is market depth analysis. This article will delve into the world depth analysis of the world and study its importance to understand the potential of cardano.

What is Market Depth Analysis?

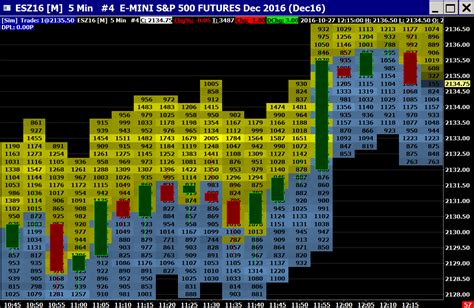

Market depth analysis is a technical tool used by merchants, analysts and investors to assess market mood and liquidity in different financial markets. This includes an analysis of several data points to assess the number of unpaid contracts, the difference between the price and the transfer and the flow of orders at different price levels. In doing so, market depth analysis provides a valuable insight into market dynamics, allowing individuals to make more informed decisions.

Market depth analysis Cardano (Ada)

The Kardano market is no exception when it comes to market depth analysis. As a decentralized cryptocurrency, the ADA market is characterized by high liquidity and low volatility compared to other cryptocurrencies. In order to gain a deeper understanding of the potential of ADA, let’s check the current state of its market depth.

Main metrics

1

Price and volume (p/v) ratio : A measure calculating price movements relative to trade volume. The lower P/V ratio indicates higher liquidity and volatility.

- Bid-written played : The difference between the price price and the requested price on different stock exchanges. Less prevalence indicates greater liquidity and better market depth.

3

Order Flow : The number of purchases and sales orders at a specified period, often measured in thousands. Higher flow flow indicates increased purchase pressure.

- Depth : Measures the average quantity traded per share or coin per day.

Ada Market Depth Current condition

Using data from reputable sources such as CoinMarketcap and Cryptoslate, we can observe that the depth of the Kardano market is:

* High liquidity : P/V ratio ADA is relatively low, indicating high volatility.

* Low Prevent : Bid-Pack judge is small, indicating a better market depth.

Significant order flow : The order flow indicates an increased purchase pressure that could be a bullish sign.

Interpretation and analysis

From the current state of the depth of the Market of the current ADA:

1

ADA Potential : With high liquidity, low volatility and significant sequence flow seems to be a favorable environment for growth.

- Risk Assessment

: The relatively low ratio of P/V and the slight price and giving difference may indicate a certain level of risk, but the overall trend shows that ADA is still an attractive investment option.

3

Market Mood : The current market depth analysis shows that investors are ready to buy ADA at the price levels at the bullish mood.

Conclusion

Market depth analysis provides a valuable insight into the potential of cardano and can help traders and investors make conscious decisions on their investments. Although the data may indicate a certain level of risk, the overall tendency suggests that ADA is still an attractive investment option. As market conditions develop, it will be important to keep track of the latest market depth analysis in order to benefit from all the options that arise.

suggestions

1

Long -term investors : Consider a long -term position, as the current market depth analysis may indicate increased purchase pressure.

- Risk Prevention Investors

: Be cautious about potential risks and consider limiting or diversifying your portfolio with other assets to manage exposure.

Leave a Comment